Notice, this text is taken from the RCR editorial report on Non-public 5G for IoT, revealed in July. The next is the primary a part of the foreword to the report. Go right here to obtain the total report. It additionally takes and collates excerpts from varied different articles which have appeared over latest months on RCR Wi-fi. The topic might be additional explored within the upcoming Industrial 5G Discussion board on November 7; enroll right here.

As written (twice), the reality about personal 5G, definitely as far as IoT and Business 4.0 goes, might be discovered someplace between the determined pleasure of MWC and the distracted indifference of Hannover Messe. And of those twin occasions, which bookend the spring season and dictate the remainder of the economic tech calendar, the temper within the industrial IoT person market in 2023 invariably lies nearer to the gleichgültigkeit (we needed to look that up!) of the large German truthful – if solely as a result of it takes a vertical focus, as an alternative of only a horizontal one, and so the crosshairs extra simply align.

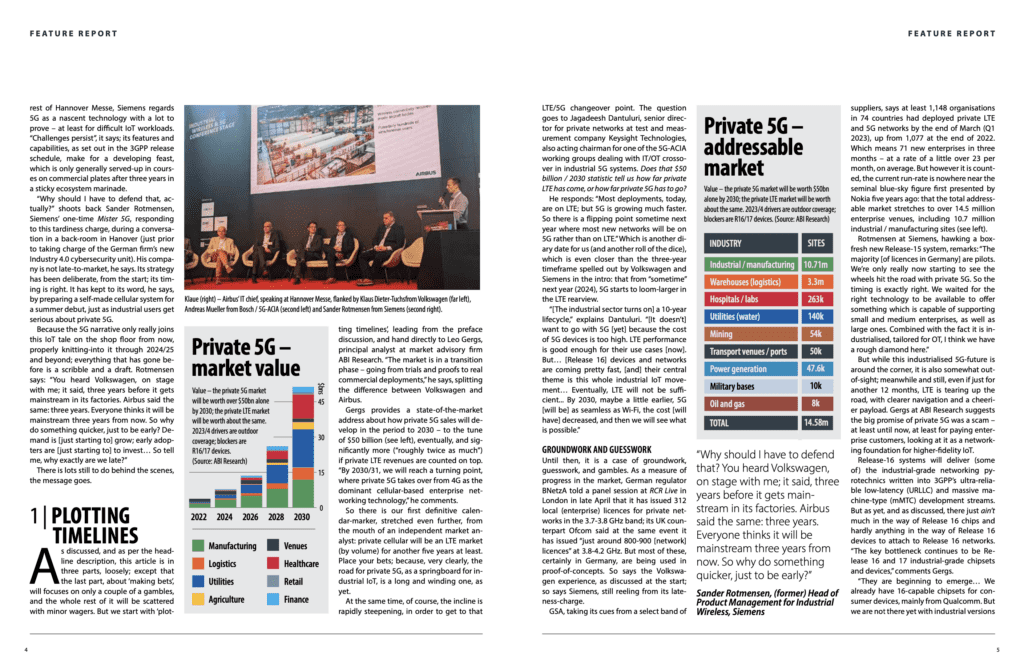

Take Volkswagen, the most important automobile maker on the earth, and absolutely the final word bellwether for these items; the Wolfsburg agency instructed Hannover Messe in April about its emotions and findings, and prompt 5G is simply one other waypoint on the Business 4.0 highway – and a great distance off, nonetheless. (However what else did we count on, as this text will conclude?) Flanked on a panel by Airbus, Bosch, Siemens, plus some others, Klaus Dieter-Tuchs, head of business networking planning on the agency, places the spring-time MWC hullabaloo about personal 5G into some sort of perspective.

“We see 5G as simply one other know-how to entry the central IT community. For us, [it] is a small a part of a whole community,” he says, earlier than itemizing all the issues with personal 5G, as introduced to the economic IoT market in the present day. It was according to the message from the remainder of the present: that personal 5G is just not a 2023 story, and possibly not even a 2024 one. It is going to take till 2024/25 to realize any sort of actual buy with the economic set, to ship digital change for sure brownfield use instances.

Volkswagen stays very a lot in take a look at mode with personal 5G-for-IoT, like many enterprises in Germany – which, as the unique residence of Industrie 4.0, may additionally be thought-about to be a geographic bellwether for hard-nosed industrial-grade 5G. The corporate has 4 completely different take a look at networks with 4 completely different automobile marques; with Audi in Ingolstadt, Porsche in Leipzig, Volkswagen in Wolfsburg, and Skoda someplace within the Czech Republic. Every one is from a unique community vendor – which says, as a lot as something, that enterprises are nonetheless weighing the chances and hedging their bets.

“We are attempting completely different distributors to realize expertise for reside manufacturing networks. However now we have no reside networks, as but – and we will’t say [exactly] once we may have them.” Dieter-Tuchs suggests, a bit vaguely, that Volkswagen may have commercially-active networks “within the subsequent months,” but in addition raises agitated considerations about person gear, machine authorisation, and community integration (mentioned variously in components two and three). The purpose is barely to mark the calendar: in mid-to-late 2023, personal 5G for IoT is a analysis mission, largely – not less than the place the 2 disciplines cross in industrial climes.

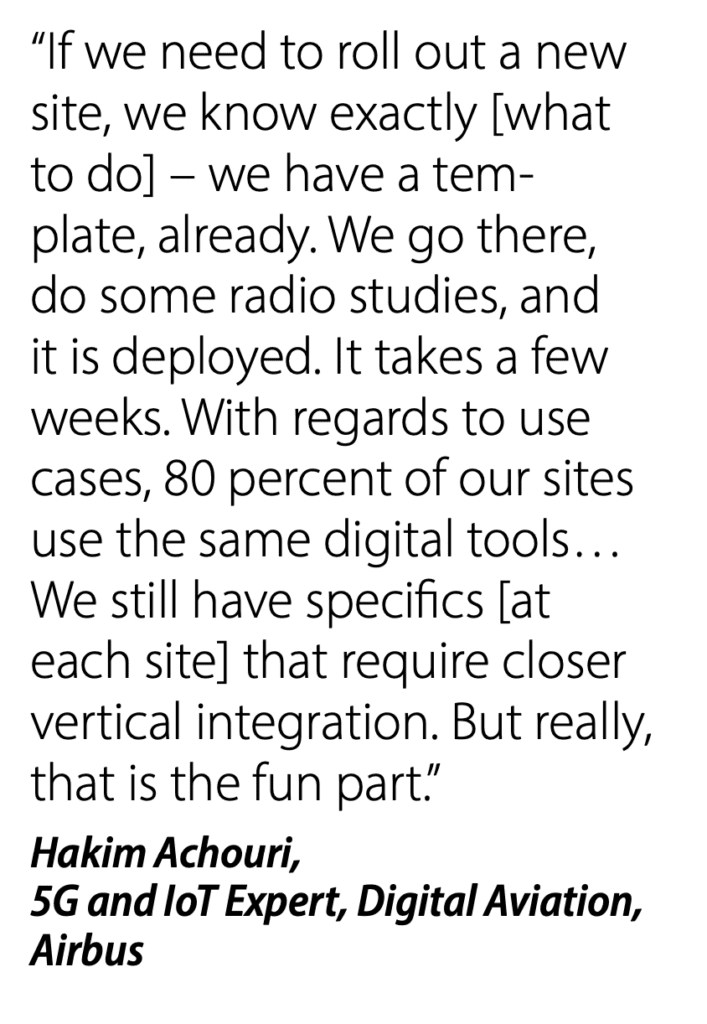

That is bolstered by the experiences of Airbus and Siemens, talking on the panel as effectively, and in dialog individually with RCR Wi-fi. Airbus is additional together with reside deployments. It has 11 networks at 11 websites, all of them deployed for IoT workout routines of 1 sort or one other. However it’s increasing past its core manufacturing bases in France and Germany, to additionally deploy in Canada, China, Spain, the UK, and the US. And it’s doing so with a cookie-cutter blueprint – based mostly on the precept that what works as soon as works each time (counter to the generalist provider narrative that each plant is completely different).

Architecturally, it’s pretty simple, declares Hakim Achouri, 5G and IoT knowledgeable for digital aviation on the agency. It takes some radio planning, however not a lot; two-weeks, from begin to end, with an 80/20 rule for functions on prime, as effectively. “If we have to roll out a brand new website, we all know precisely [what to do] – now we have a template, already. We go there, do some radio research, and it’s deployed. It takes a couple of weeks. Almost about use instances, 80 % of our websites use the identical digital instruments… We nonetheless have specifics [at each site] that require nearer vertical integration. However actually, that’s the enjoyable half.”

The important thing message, from Achouri, talking at RCR Wi-fi’ flagship industrial 5G-IoT occasion, 5G Manufacturing Discussion board, on the finish of final yr (2022), is to be daring. As a result of enterprises know their enterprise greatest, and since late-LTE and early-5G is nice to be occurring with. Which makes 5G-for-IoT sound like a no-brainer. However Airbus additionally acknowledges in Hanover, some months later, that it’s nonetheless kicking the tires, basically; the hard-ROI of sign protection and predictability is obvious (see half two), it says, however choices about community administration and rollout technique are nonetheless to be made.

“We don’t know but. For the time being, we’re doing all of it ourselves. However to scale worldwide, we are going to in all probability outsource the service. And it’ll take some years to deploy the whole lot in all crops,” feedback Jirka Klaue, from the agency’s IT division. Ultimately, Volkswagen and Airbus, each perceived as Business 4.0 flag-bearers, are at reverse ends of the preliminary 5G-IoT adoption curve: one is caught in an experimentation rut, successfully, and the opposite is in some sort of commercialisation groove. However each of them nonetheless have looking questions on 5G-for-IoT; neither have gone all-in.

Munich-based Siemens, one of many rarefied breed eager about each promoting and using 5G-IoT techniques, has solely simply launched its personal home-grown answer, and solely simply in its residence market – to be used within the native 3.7-3.8 GHz band, reserved for enterprises to run personal 5G networks. It has plans – clear, but in addition imprecise – to promote outdoors Germany, too, beginning in Brazil, the place the identical vertical spectrum has been allotted. It says it can comply with in different markets according to demand, elevating bandwidth capabilities to fulfill the three.8-4.2 GHz band, round which most of Europe is congregating.

There may be an argument – put, sometimes, by conventional telco-native 5G distributors – to say that Siemens is late-to-market. However like Volkswagen and Airbus, and a lot of the remainder of Hannover Messe, Siemens regards 5G as a nascent know-how with quite a bit to show – not less than for troublesome IoT workloads. “Challenges persist”, it says; its options and capabilities, as set out within the 3GPP launch schedule, make for a growing feast, which is barely typically served-up in programs on industrial plates after three years in a sticky ecosystem marinade.

“Why ought to I’ve to defend that, really?” shoots again Sander Rotmensen, Siemens’ one-time Mister 5G, responding to this tardiness cost, throughout a dialog in a back-room in Hanover (simply previous to taking cost of the German agency’s new Business 4.0 cybersecurity unit). His firm is just not late-to-market, he says. Its technique has been deliberate, from the beginning; its timing is correct. It has stored to its phrase, he says, by getting ready a self-made mobile system for a summer time debut, simply as industrial customers get severe about personal 5G.

As a result of the 5G narrative solely actually joins this IoT story on the store ground from now, correctly knitting-into it via 2024/25 and past; the whole lot that has gone earlier than is a scribble and a draft. Rotmensen says: “You heard Volkswagen, on stage with me; it stated, three years earlier than it will get mainstream in its factories. Airbus stated the identical: three years. Everybody thinks it will likely be mainstream three years from now. So why do one thing faster, simply to be early? Demand is [just starting to] develop; early adopters are [just starting to] to take a position… So inform me, why precisely are we late?”

There may be tons nonetheless to do behind the scenes, the message goes.

This text is sustained within the RCR editorial report on Non-public 5G for IoT, obtainable to obtain right here. The topic might be additional explored within the upcoming Industrial 5G Discussion board on November 7; enroll right here.