In my 18+ years in search advertising, one factor I�ve seen constantly is shared budgets.

After I ask the advertiser why, I all the time get an analogous reply: �We now have a set restricted finances, and that is one of the simplest ways for us to fund every little thing.�

That could be a response I get from mom-and-pop operations and SMBs, all the best way as much as main holding firm advert businesses and Fortune 100 enterprise manufacturers.

The fact is, generally this strategy works high quality, and different instances you’re inadvertently capturing your self within the foot, as your shared spend finally ends up limiting your potential return.

The Scenario

The very fact is a shared finances (usually referred to as a portfolio finances) does, in actual fact, assist bandwidth-strapped operations (i.e., actually each advertising staff on Earth) in avoiding overspending in a single engine.

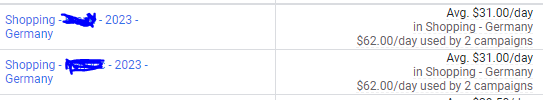

-

Picture from creator, August 2023

Picture from creator, August 2023

Nevertheless, a shared finances rewards the high-volume or high-demand components first.

It�s primarily like making an attempt to get Taylor Swift tickets � those that are available in quick and with deep pockets get the tickets, and everybody else loses out.

The Affect

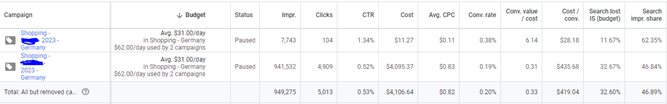

That is cute till you notice you may have a low conversion rate-producing marketing campaign that has excessive quantity in visitors, sharing a finances with a marketing campaign that has a low demand in visitors however is producing a excessive conversion price.

Thus, the underproducing however high-volume marketing campaign will take a disproportionate quantity of the finances primarily based on every day demand, doubtlessly diminishing the chance or period of time the high-producing marketing campaign can present (as considered in Impression Share and Impression Misplaced to Finances).

That is also known as finances cannibalization.

Or when one entity takes a disproportionate quantity of the overall allotted finances towards the entities it shares the funds with.

-

When one marketing campaign cannibalizes the spend of a shared finances.

When one marketing campaign cannibalizes the spend of a shared finances.

This, in flip, reduces the mixture efficiency (which might solely be checked out as combination as a result of they share the finances) of the campaigns sharing the finances.

To place this in a distinct perspective: That is like claiming all New York NFL groups are mediocre at finest as a result of the Jets haven�t made the playoffs since 2010, regardless of the actual fact the Payments and Giants each went into the playoffs in 2022.

NY shares an NFL affiliation, however one entity is discouraging the arrogance because it brings down the remaining.

The Fallout

For those who�ve learn any of the above, this must be pretty easy, however to put it out properly:

You handled two campaigns like they had been equals and advised them to share some cash evenly.

This doubtlessly may have left you with a missed alternative for visitors and conversions.

The Repair

I ought to notice that each operation is totally different. Some could not fall into this state of affairs, and a few will � I see it extra usually in smaller businesses and types which are strapped for bandwidth.

My private choice, and I train this strategy at any time when I can, is to have standalone, every day finances caps by the person marketing campaign.

Notice: I stated every day. If this marketing campaign is ongoing or evergreen, don�t use a marketing campaign complete; it�ll change into a ache within the butt for you later. Solely use marketing campaign complete for brief marketing campaign flights with predefined finish dates.

From there, I work manually to maintain the budgets fluid between campaigns � which means that I’ll manually shift funds between campaigns. If one is outperforming one other and may tackle extra finances, then I’ll make the required shift.

We make choices on finances migration by way of guide monitoring (which I want, although there are many methods to do it) of spend pacing. I like to do that every day because it retains us recent, however you�ll know the proper interval in your staff.

Then examine the campaigns towards which campaigns are assembly or exceeding our goals vs. these which are underproducing towards the goals.

When Are Shared Budgets Applicable?

This can be a bit subjective, however there are occasions when it will probably change into acceptable.

One of many extra frequent ones is once you�ve break up your campaigns by units (i.e., Marketing campaign 1 is mobile-only, and Marketing campaign 2 is desktop-only).

Right here, presumably, the key phrases, belongings, and concentrating on are all the identical, however it simply so occurs you may have a justified purpose to separate the campaigns. So having the campaigns share a finances is ok.

However you need to carefully monitor efficiency, as cellular usually takes the lion�s share of visitors and should trigger marketing campaign cannibalization of desktop. (This was much less of an issue again within the day when cellular value per click on (CPCs) had been considerably decrease than desktop, however 55%-65% of the overall visitors.)

This may also be relevant when a number of campaigns have the identical belongings and concentrating on however are splintered by match sort on the marketing campaign degree � which, consider it or not, continues to be a typical apply.

A shared finances works high quality, and in idea, it will replicate the state of affairs in case you break up the match varieties in a single marketing campaign however on the advert group degree.

The one caveat is that broad match will have to be watched like a hawk, as that usually tends to be a driving drive of search quantity.

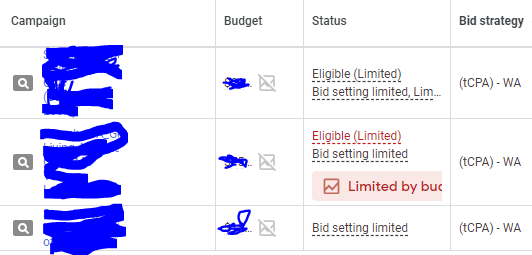

One other one is when utilizing a portfolio bid technique. When a bunch of campaigns share a single objective, and there’s no disproportionate demand in quantity, they are often put right into a shared bid technique.

This can be a time when utilizing a shared finances is sensible, as all components are working collectively for a typical objective (type of like a Efficiency Max strategy with the totally different advert items).

-

Shared finances with portfolio bid technique.

Shared finances with portfolio bid technique.

The Takeaway

First, a pleasant reminder that shared budgets aren�t even relevant to all campaigns (i.e., campaigns in experiments or Efficiency Max don�t qualify to make use of them).

Subsequent, if you’re utilizing shared budgets: earlier than you go and make modifications to choose out of them after studying this inspirational article, you could first do some evaluation.

In campaigns utilizing a shared finances, take a look at issues like:

- Is one marketing campaign significantly outperforming one other one by way of return?

- Is one marketing campaign consuming a disproportionate quantity of the finances (and never the highest performer of those that share the finances)?

- Do you may have the bandwidth to handle and preserve particular person marketing campaign budgets? All the time calculate the price of manpower when doing return evaluation.

- If they’ve a portfolio bid technique, is the finances additionally shared?

For those who�ve executed this, and determined it will profit you to attempt a person finances over a shared one, then completely proceed and try it out.

Simply needless to say you might even see an enchancment in your goal marketing campaign however run the danger of an adversarial influence on the opposite campaigns that shared the finances.

Completely satisfied search advertising!

Extra assets:�

Featured Picture: one picture/Shutterstock