Join every day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

Each MG4 and Volvo EX30 attain file leads to June.

Some 294,000 plugin autos have been registered in Europe in June, which suggests it’s one other month within the crimson yr over yr (-5% YoY). That’s contrasted with what the general market skilled (+4% YoY).

Taking a extra targeted examination of the market, BEVs have been mainly flat (0% YoY), whereas this time PHEVs took the blame for the autumn, dropping by 15%.

However to actually perceive what’s going on, we have to dig deeper to see the explanations for these numbers.

The primary issue to think about is the introduced tariff improve for Made-in-China (MiC) BEVs, which pushed the BEV market right into a small gross sales rush. That led to file registrations of MiC fashions, just like the MG4 and the Volvo EX30.

And now, the second issue to soak up account is the end-of-subsidies-derived doom and gloom in Europe’s largest automotive market, Germany. Germany is having a horrible 2024 in relation to plugin gross sales, and particularly BEVs, with the latter falling 18% YoY in June.

If we have been to exclude Germany from the BEV gross sales tally, we’d see that in June, as a substitute of staying flat, the European BEV market would have grown by 5%, which admittedly will not be so much, particularly contemplating what’s going on in China, however it could imply that the BEV market would develop quicker than the general market (5% vs. 4%), thus permitting it to achieve market share.

Yep, proper now, Germany is dragging down the EV momentum in Europe.

Wanting on the different powertrains in the marketplace, plugless hybrids have been the quickest solely rising know-how in June, with +24% YoY progress. They represented 30% of the entire market. Added to the 22% of plugin autos, one can say that over half (52%) of the European automotive market is already electrified … in a roundabout way. However, for some to develop, others should decline. Petrol dropped by 3% and diesel by 2%. Diesel autos had solely 11% of the European passenger automotive market in June 2024, a far cry from the 50% share that they had in 2015 or the 55% common it skilled earlier than that. At this price, on this class, diesel shall be useless by 2028, nicely earlier than the 2035 ICE ban….

June’s plugin car share of the general European auto market was 22% (16% full electrics/BEVs). That end result saved the 2024 plugin car share at 21% (14% for BEVs alone) by the tip of June.

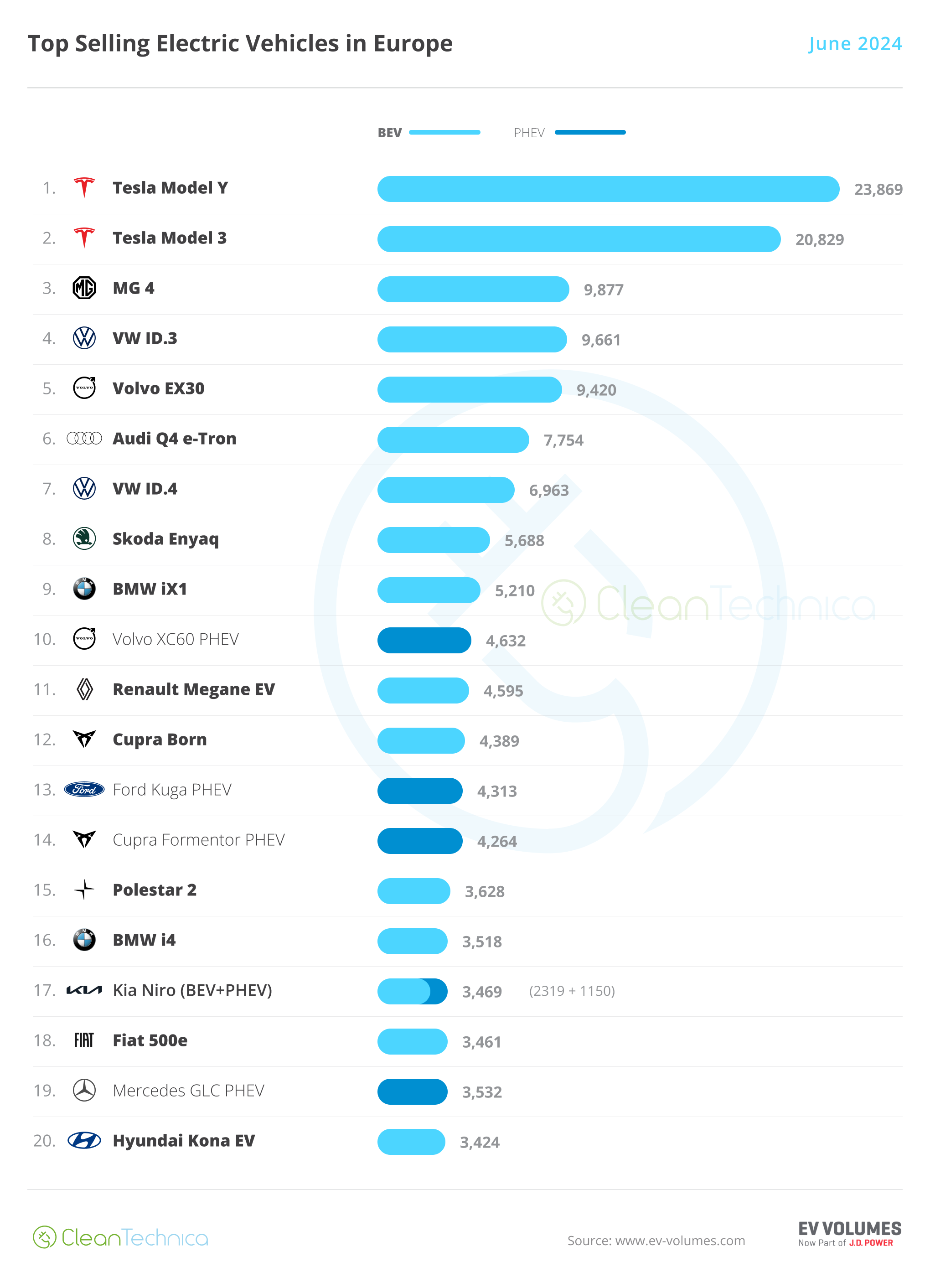

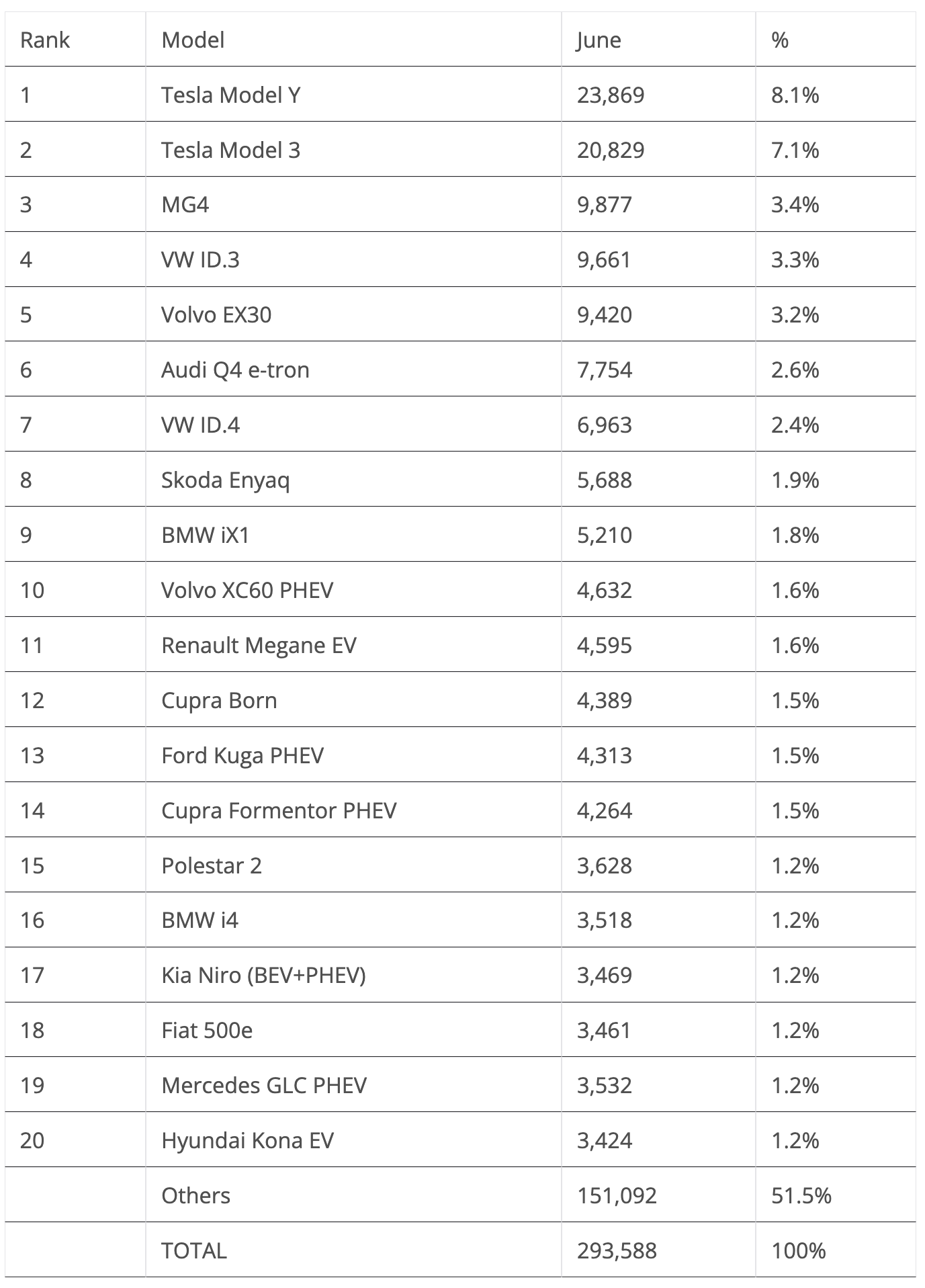

The highlights of the month have been the Made-in-China fashions, subsequent to a stunning efficiency from the VW ID.3. However let’s look nearer at June’s plugin prime 5:

#1 Tesla Mannequin Y — For the nth month in a row, Tesla’s crossover was the most effective promoting EV in Europe. However regardless of this, issues look shaky for the US crossover. In June, the midsizer had 23,869 registrations, which was down 28% YoY. Keep in mind after I talked about that 2023/24 could be thought-about the “Peak Mannequin Y” interval in Europe? It’s beginning to present. The midsized crossover’s deliveries have been down 26% YoY within the first half of the yr in Europe, because the market’s pure limits (and new competitors) are beginning to chew. Add the refreshed Tesla Mannequin 3, which is stealing gross sales in some markets, and the Mannequin Y’s efficiency will not be as superb because it as soon as was. And this time it even had some competitors for the management place, with the runner-up Tesla Mannequin 3 ending some 3,000 models behind. Positive, 3,000 models will not be 300, so the US crossover didn’t actually need to sweat to maintain the #1 spot, however the Mannequin Y’s domination will not be as undisputed now because it as soon as was. It will likely be attention-grabbing to see what’s going to occur in July. Relating to June’s efficiency, the Mannequin Y’s largest European markets included the UK (3,620 models), Germany (3,346 models), France (2,156 models), Norway (2,324 models), and Sweden (2,121).

#2 Tesla Mannequin 3 — Not like in China, final yr’s refresh has helped the Mannequin 3’s profession in Europe, and with the tariff improve coming quickly, the sedan skilled a larger tide than traditional, permitting the sedan to have its finest efficiency since March 2022 in June, 20,829 deliveries. Regardless of the latest uptick, although, the veteran BEV (it was launched again in 2017) is much from its finest days. It gained the Greatest Vendor trophy in 2019 and 2021. Now, all it may aspire to is protecting the runner-up standing away from fashions just like the Volvo EX30. Again to June’s efficiency, the Mannequin 3’s most important markets have been Italy, with a stunning 3,280 deliveries, the UK (3,111 registrations), France (1,821 registrations), Denmark (1,656 registrations), and the Netherlands (1,664 registrations).

#3 MG4 — One other mannequin to learn from the Made-in-China (MiC) tariff improve and expertise file gross sales ranges, this compact hatchback — the value-for-money king of the class — had 9,877 gross sales, the MG4’s finest efficiency thus far. With costs beginning at round 30,000€ and having first rate specs, this next-generation Ford Focus from one other mom is proving to be fairly fashionable, even outselling the native heroes, the VW ID.3 and Renault Megane EV. June’s efficiency, the spotlight is Germany, the MG4’s largest market(!), the place it acquired 4,492 registrations. In its adopted residence market, the UK, it had 1,024 registrations. France (1,169 registrations) and Norway (1,171 registrations) additionally deserve a point out.

#4 VW ID.3 — The Volkswagen hatchback is returning to type, scoring 9,661 registrations in June, its finest end in 18 months. With demand recovering, because of the latest refresh, the ID.3 is hoping to be again within the sport. A prime 5 place is feasible for 2024, however it should rely so much on how deeply affected their MiC adversaries shall be by the latest tariff improve. However sufficient of futurology and again to the hatchback’s June efficiency — its largest market was by far its home one, with Germany offering a tremendous 6,370 registrations (frankly, I discover it too good to be true, as this should have been related to some fleet deal — shall be attention-grabbing to see how a lot quantity the ID.3 will ship within the subsequent couple of months). Following Germany, at a distance, have been France (1,342 registrations), the UK (602 registrations), and Norway (263 registrations).

#5 Volvo EX30 — The China-made (however with a Swedish passport) crossover resides as much as the hype, by promoting a file 9,42o registrations in June. Though, one has to surprise how a lot of it was natural demand and the way a lot was because of the elevated tariffs for made-in-China fashions and the frenzy to get them earlier than the tariffs have been utilized. At present Volvo’s least expensive mannequin, it begins out at 39,000 euros, versus the 40,000 euros of the gasoline XC40. The EX30 can be Volvo’s smallest mannequin — the dimensions of a VW ID.3. Whereas it can’t be thought-about low cost (for that, it must price lower than 35,000 euros), it may however be thought-about nicely priced, particularly contemplating the premium standing it holds. Relating to the EX30’s June outcomes, the distribution is balanced. Germany (1,199 registrations) leads, barely forward of the Netherlands (1,172 registrations), with Norway (1,080 registrations) and the UK (1,074 registrations) staying just under the highest two. As such, one can say that the supply ramp-up of the EX30 is now completed, and we’ll now begin to see the cruising velocity of Volvo’s smaller BEV.

the remainder of the June desk, there are a number of fashions hitting year-best outcomes, three of them BEVs from Volkswagen Group. The #7 spot of the VW ID.3 was celebrated with 6,963 gross sales, instantly adopted in #8 by its Czech cousin, the Skoda Enyaq (5,688 gross sales), whereas the Cupra Born stayed in twelfth with 4,389 gross sales. The MEB platform positioned 5 representatives within the prime 20.

Elsewhere, there have been additionally different fashions shining, just like the #9 BMW iX1. With 5,210 gross sales, it had its finest rating in 2024. The #11 Renault Megane had its finest end in a yr, with 4,595 registrations (see, Renault — if costs drop, gross sales improve; it’s so simple as that). In the meantime, the Polestar 2 additionally benefitted from the MiC gross sales rush, scoring 3,628 gross sales, its finest end in 11 months.

Lastly, wanting on the PHEV class, regardless of the Volvo XC60 PHEV gathering one other finest vendor prize, with 4,632 gross sales, permitting it to finish in tenth, the spotlight was the Cupra Formentor PHEV. The sporty crossover hit a file end result, 4,264 gross sales, and count on it to proceed among the many class finest sellers, because the improved specs (26 kWh battery, DC charging) will certainly make it some of the attention-grabbing proposals within the class.

Chip in a number of {dollars} a month to assist assist unbiased cleantech protection that helps to speed up the cleantech revolution!

Under the highest 20, one spotlight was the BMW iX3 registering 2,071 models, a brand new yr finest. It’s absolutely one other mannequin to learn from the MiC gross sales rush. However BMW had one other mannequin additionally within the quick lane, with the i5 reaching 1,858 registrations. Though that wasn’t sufficient to beat the class chief, the Porsche Cayenne PHEV, it however outsold the Mercedes EQE, its arch rival, and guarantees to be robust competitors for the a lot awaited Audi A6 e-tron.

Different highlights are the manufacturing ramp-up of the Renault Scenic EV crossover — with 2,260 registrations in June, it’s beginning to turn into prime 20 materials. Elsewhere, the Hyundai Ioniq 5 scored 2,737 registrations, its finest end in 10 months, whereas the Jeep Avenger scored its finest end result this yr in June, due to 2,022 deliveries.

Lastly, a few different fashions additionally had a slight bump in gross sales due to the tariff improve. The brand new Mini Cooper EV had 2,207 gross sales and the MG ZS EV had 2,018 gross sales.

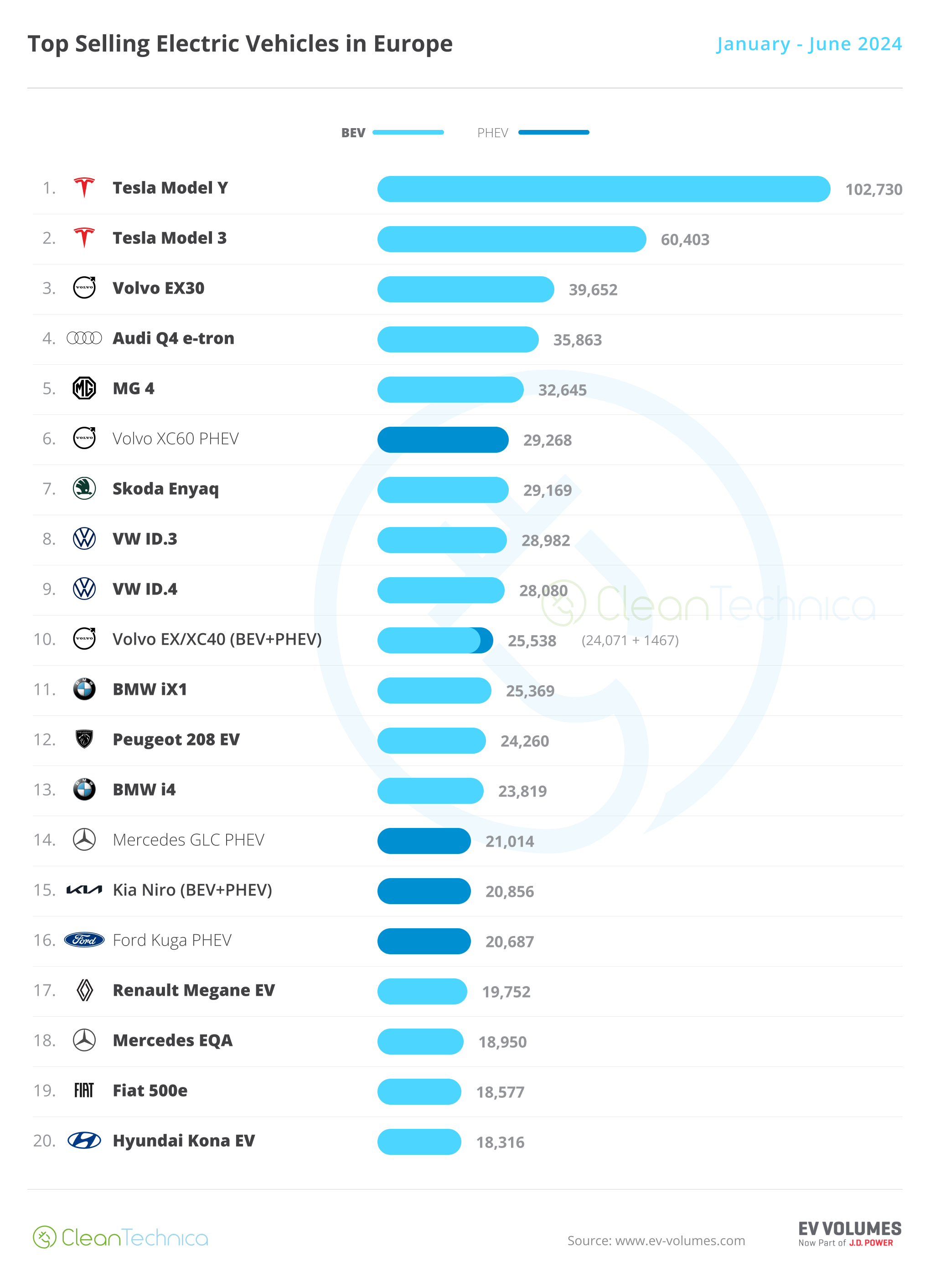

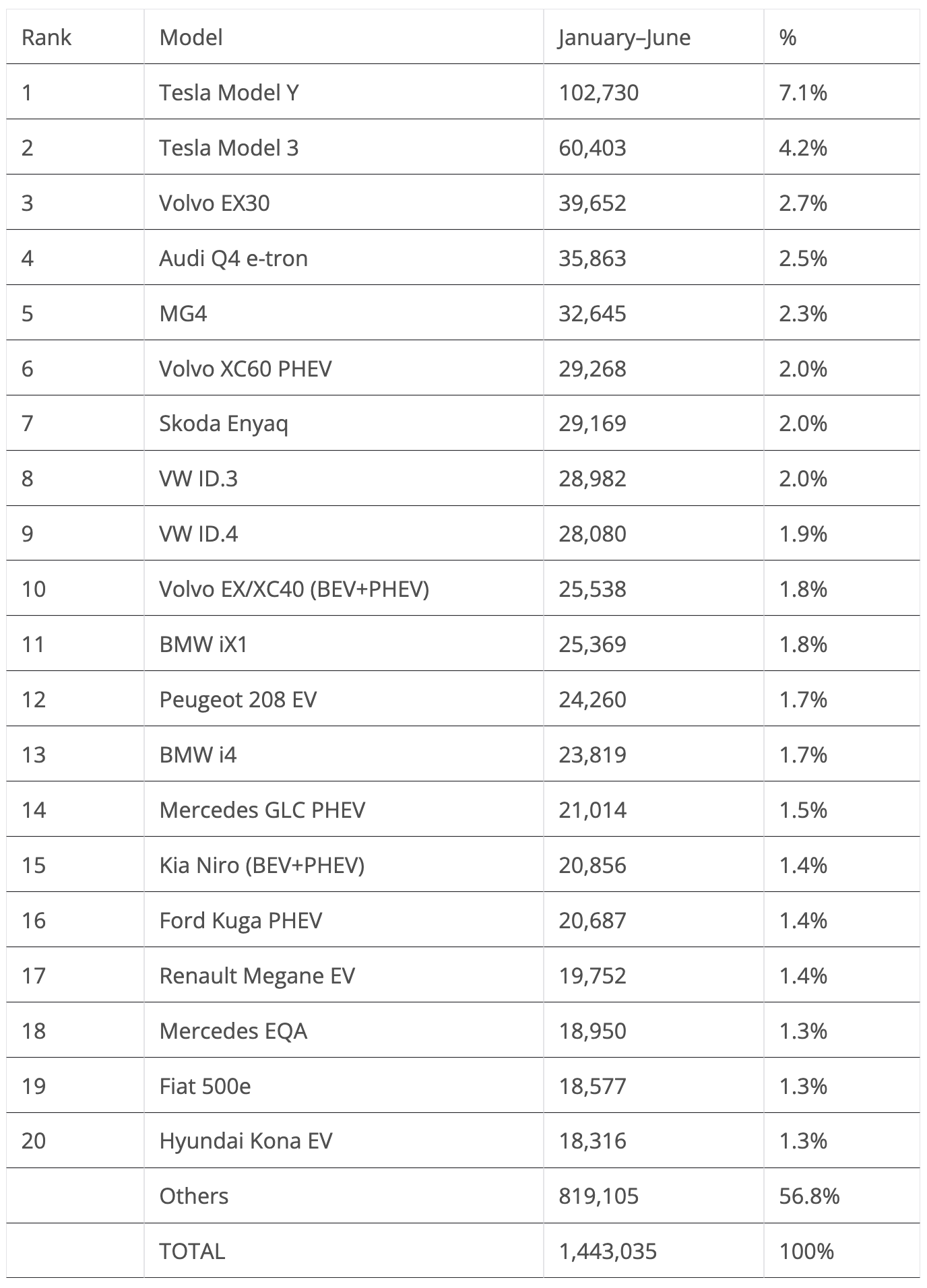

Wanting on the 2024 rating, with the chief, the Tesla Mannequin Y, having a 40,000-unit lead over the runner-up Tesla Mannequin 3, the management place is already taken and the Mannequin Y is ready to win its third Greatest Vendor title in a row.

Under it, it appears the Tesla Mannequin 3 has now secured the runner-up place, having gained a bonus of greater than 10,000 models over the #3 Volvo EX30 in only one month. So, this one also needs to be secured, and Tesla will probably have a gold plus silver end in Europe this yr.

As for the third spot, the image is much less clear, as a result of it isn’t sure how the latest tariff improve will have an effect on the Volvo EX30. With 4,000 models of advance over the #4 Audi This fall e-tron, it appears to have a big cushion over the German crossover, however time will inform how the EX30 will behave underneath the brand new situations.

The primary place adjustments occurred within the fifth place, with the MG4 leaping two positions, however the query now shall be how the Sino-British mannequin shall be impacted by the tariff improve, and what number of positions it should lose by the tip of the yr.

Nonetheless on the subject of the highest 10, VW’s finest sellers continued of their race towards time. The ID.3 jumped 5 spots, to eighth, whereas the ID.4 climbed to #9. It’s good they’re recovering misplaced time, however the third spot of the German crossover, gained in 2022 and 2023, appears already out of attain.

Elsewhere, the remaining place adjustments occurred within the second half of the desk. The BMW iX1 jumped two locations within the desk to eleventh, with the crossover now trying to acquire a place within the prime half of the desk. The Renault Megane EV profited from its latest spike in gross sales (<costs = >gross sales) to rise one place, to #17.

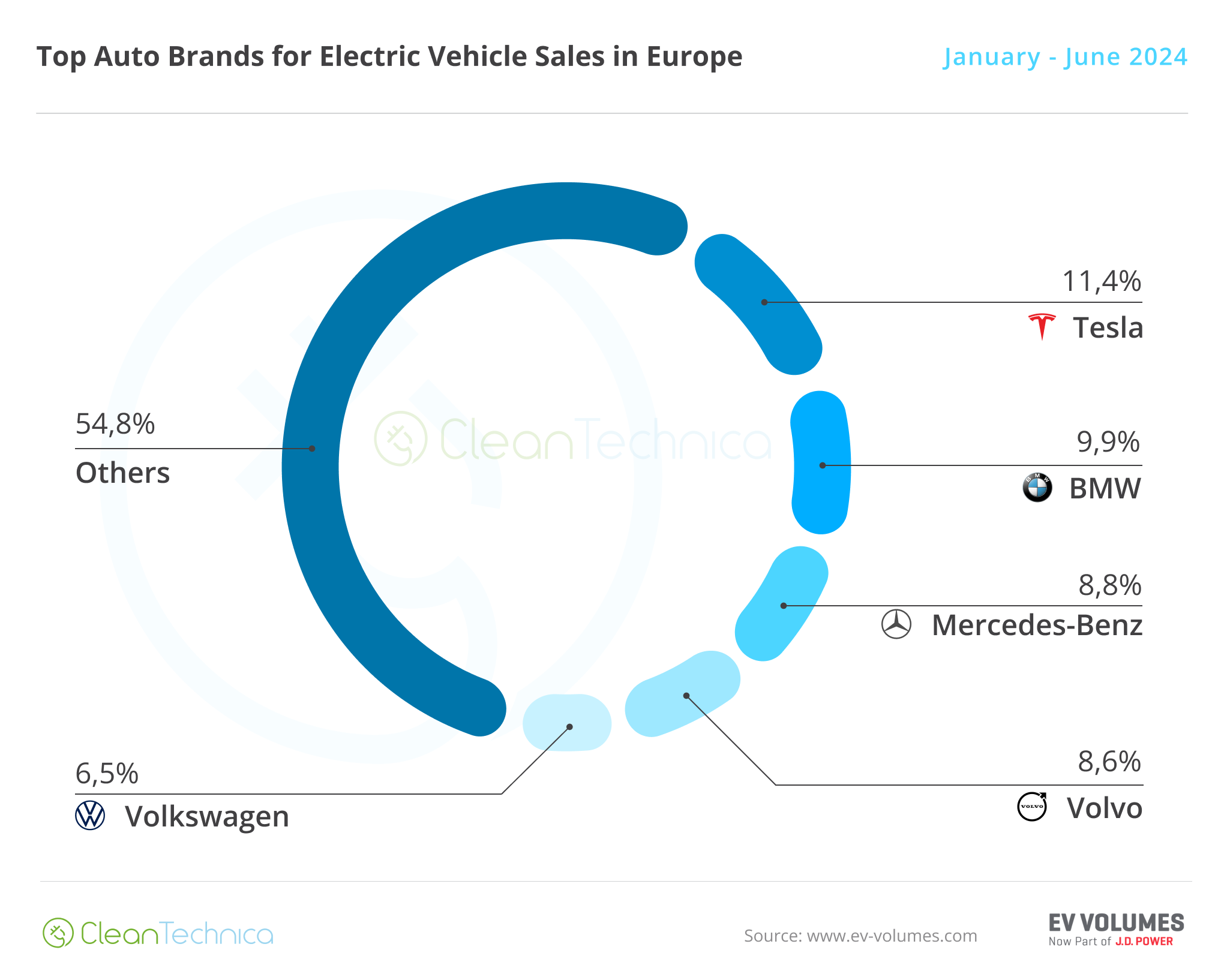

As for the plugin auto model rating, Tesla profited from the end-of-quarter peak to safe its management place (11.4% in June vs. 10.5% in Could). Though, taking a look at the place the US model share was a yr in the past, it has misplaced a big piece of the pie (13.1% in H1 2023 vs 11.4% now).

In the meantime, #2 BMW has misplaced share in comparison with Could, going from 10.3% to 9.9% share. However in contrast with the identical interval of 2023, BMW has causes to smile, because it went up from 7.9% to its present 9.9% share.

third positioned Mercedes (8.8%, down from 9% in Could) had related habits to its Bavarian rival, shedding share month over month however gaining yr over yr. It went from 7.4% in H1 2023 to eight.8% within the first half of 2024.

It’s an identical story for #4 Volvo (8.6%, down from 8.8%). Whereas it has misplaced a little bit of share in comparison with Could 2024, in comparison with the place it was a yr in the past, issues now look significantly better. The Swedish make now has 8.6% share, versus 6.2% share 12 months in the past.

Lastly, we now have a place change in #5, with a rising Volkswagen (6.5%, up from 6.2% in Could) surpassing Audi (6.5%, down from 6.7%), which is sliding because of the poor outcomes of the Q8 e-tron.

With Volkswagen having been on the European podium virtually yearly since 2015 (with the exception being 2019), count on it to do every part in its energy to push gross sales up and attain the third place. The one drawback it has is that Volvo can be going sturdy…. Nicely, nothing {that a} made-in-China tariff increase gained’t resolve … however I digress.

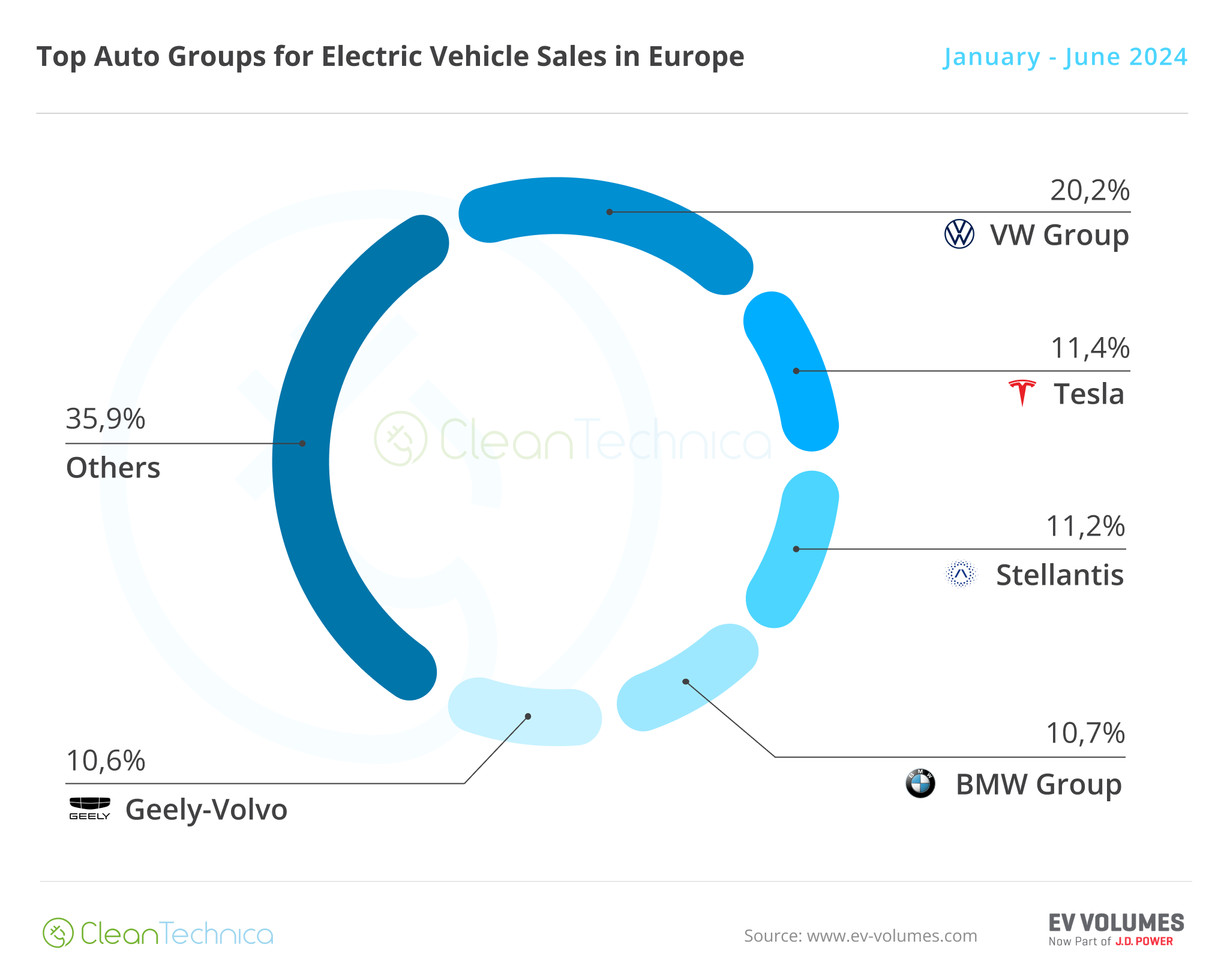

Arranging issues by automotive group, Volkswagen Group benefitted from good performances from a number of members of its model lineup. It thus rose to twenty.2% share and the German OEM is protecting a snug lead over the competitors.

The earlier runner-up, Stellantis, had one other horrible month, dropping 0.5% in share in June to 11.2%. The OEM had poor performances from a lot of manufacturers. Evaluating with final yr’s efficiency in the identical interval, issues get even worse: It has misplaced 3.1% share in 12 months. These new, low cost EVs have to land quickly, and in massive volumes, if the multinational conglomerate needs to maintain its runner-up standing in Europe.

Each BMW Group (10.7%, down from 10.9%) and Geely–Volvo (10.6%, down from 10.7%) additionally dropped, permitting Tesla to surpass three OEMs in a single month. Tesla thus ended the month within the runner-up place! Regardless of shedding 1.7% share YoY, Tesla is benefitting from the Stellantis debacle to rise one place in comparison with the place it was a yr in the past.

Off the highest 5, Mercedes-Benz Group (9.1%, down from 9.5%) is steady in sixth, and it has seen its share improve by 0.8% in comparison with a yr in the past.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage