This submit outlines use SQL for querying and becoming a member of uncooked information units like nested JSON and CSV – for enabling quick, interactive information science.

Information scientists and analysts take care of advanced information. A lot of what they analyze could possibly be third-party information, over which there’s little management. As a way to make use of this information, important effort is spent in information engineering. Information engineering transforms and normalizes high-cardinality, nested information into relational databases or into an output format that may then be loaded into information science notebooks to derive insights. At many organizations, information scientists or, extra generally, information engineers implement information pipelines to rework their uncooked information into one thing usable.

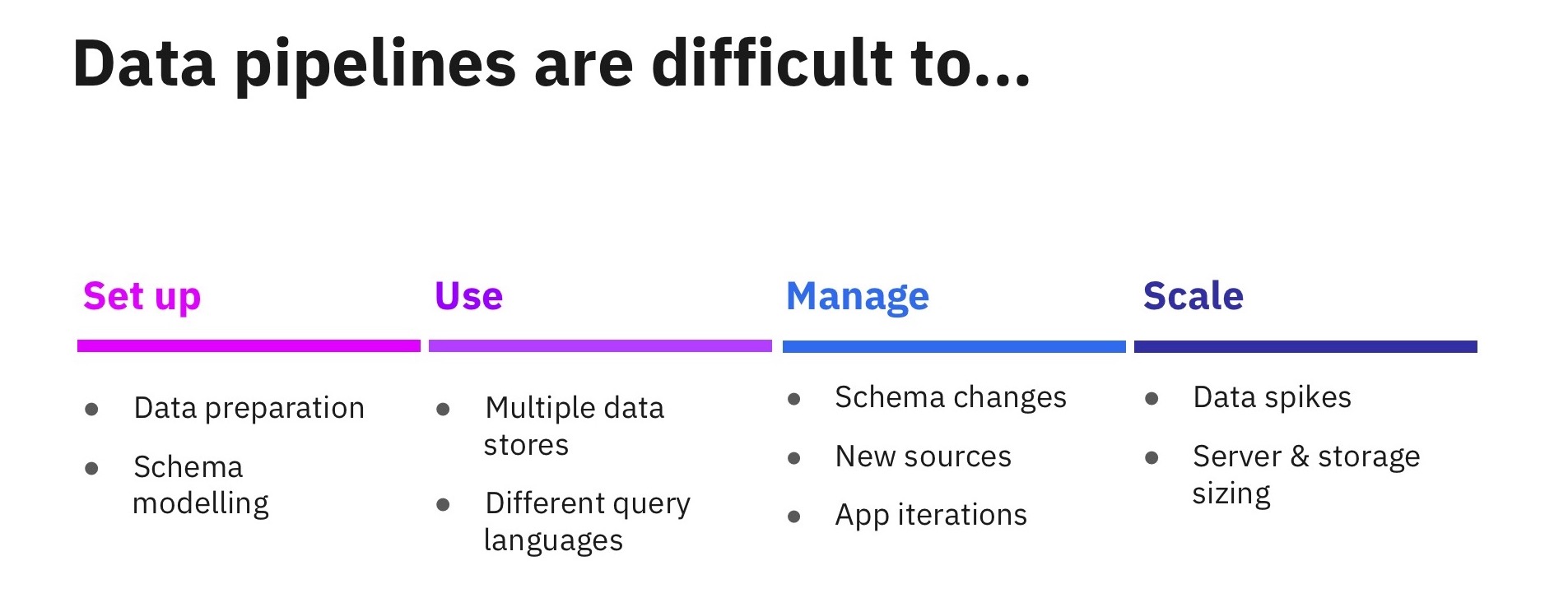

Information pipelines, nevertheless, commonly get in the best way of knowledge scientists and analysts attending to insights with their information. They’re time-consuming to jot down and keep, particularly because the variety of pipelines grows with every new information supply added. They’re usually brittle, do not deal with schema adjustments effectively, and add complexity to the info science course of. Information scientists are sometimes depending on others—information engineering groups—to construct these pipelines as effectively, lowering their pace to worth with their information.

Analyzing Third-Get together Information to Assist Funding Choices

I’ve had the chance to work with quite a few information scientists and analysts in funding administration corporations, who’re analyzing advanced information units to be able to help funding choices. They more and more herald different, third-party information—app utilization, web site visits, individuals employed, and fundraising—to reinforce their analysis. They usually use this information to guage their present portfolio and supply new funding alternatives. The everyday pipeline for these information units contains scripts and Apache Spark jobs to rework information, relational databases like PostgreSQL to retailer the remodeled information, and at last, dashboards that serve data from the relational database.

On this weblog, we take a particular instance the place an information scientist could mix two information units—an App Annie nested JSON information set that has statistics of cellular app utilization and engagement, and Crunchbase CSV information set that tracks private and non-private corporations globally. The CSV information to be queried is saved in AWS S3. We are going to use SQL to rework the nested JSON and CSV information units after which be a part of them collectively to derive some attention-grabbing insights within the type of interactive information science, all with none prior preparation or transformation. We are going to use Rockset for working SQL on the JSON and CSV information units.

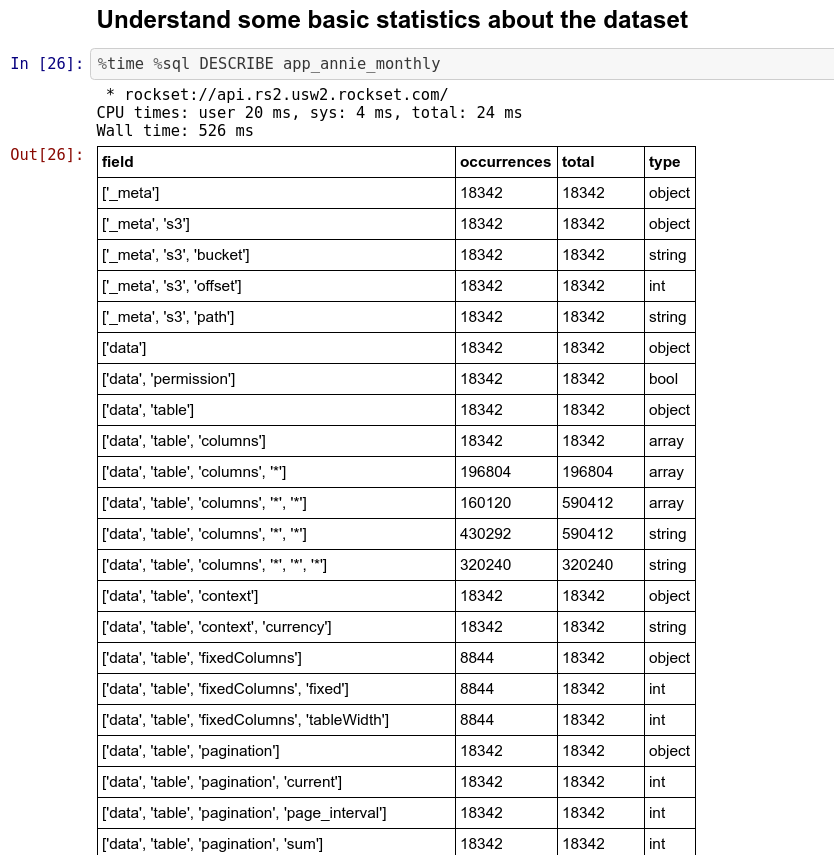

Understanding the form of the nested JSON information set utilizing Jupyter pocket book

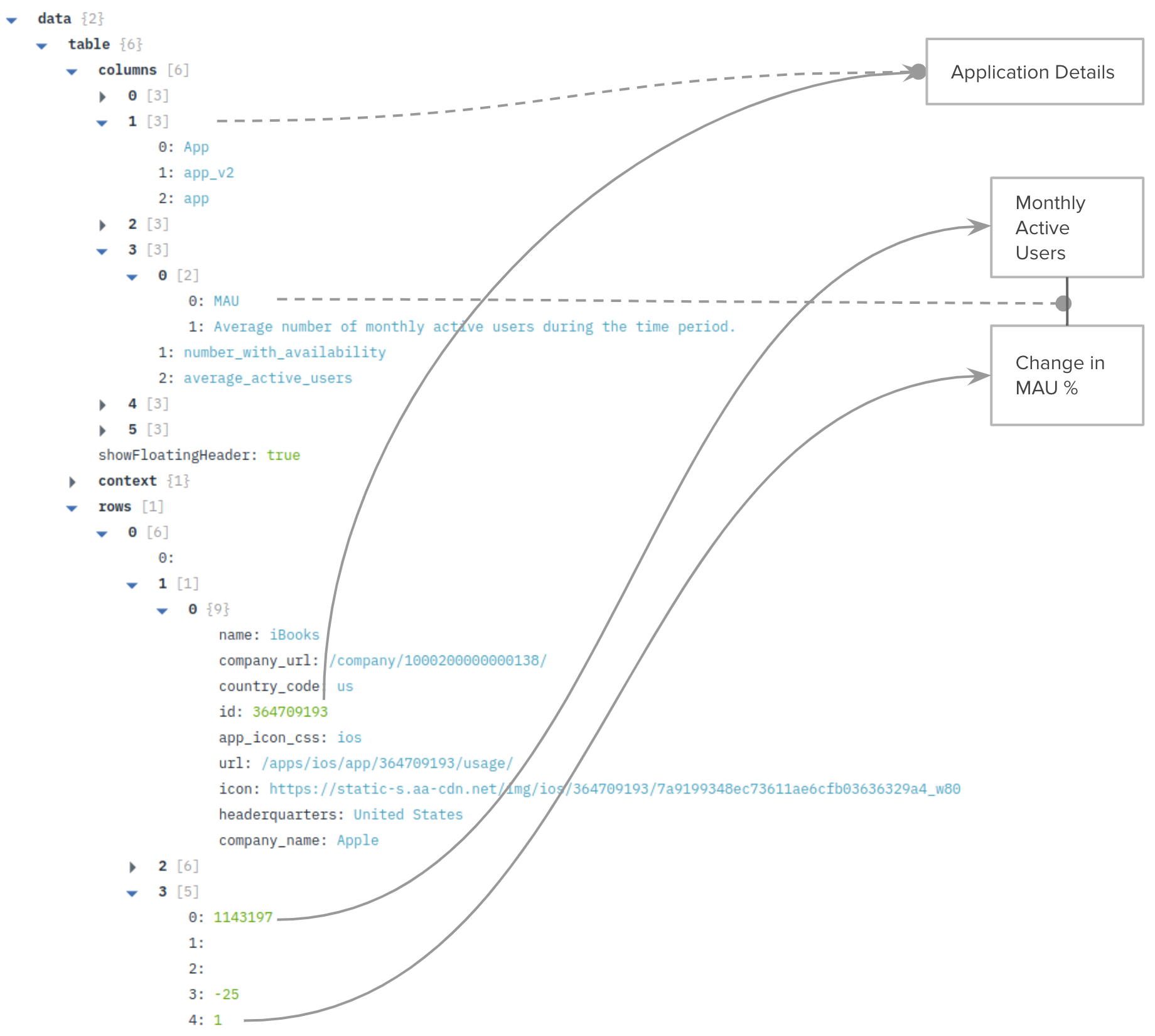

We start by loading the App Annie dataset right into a Rockset assortment named app_annie_monthly. App Annie information is within the type of nested JSON, and has as much as 3 ranges of nested arrays in it. It has descriptions of fields in columns, together with statistics of Month-to-month Lively Customers (MAU) that we’ll be utilizing later. The rows include the info equivalent to these columns within the description.

Following this, we are able to arrange our Jupyter pocket book configured to make use of our Rockset account. Instantly after setup, we are able to run some primary SQL queries on the nested JSON information set that now we have loaded.

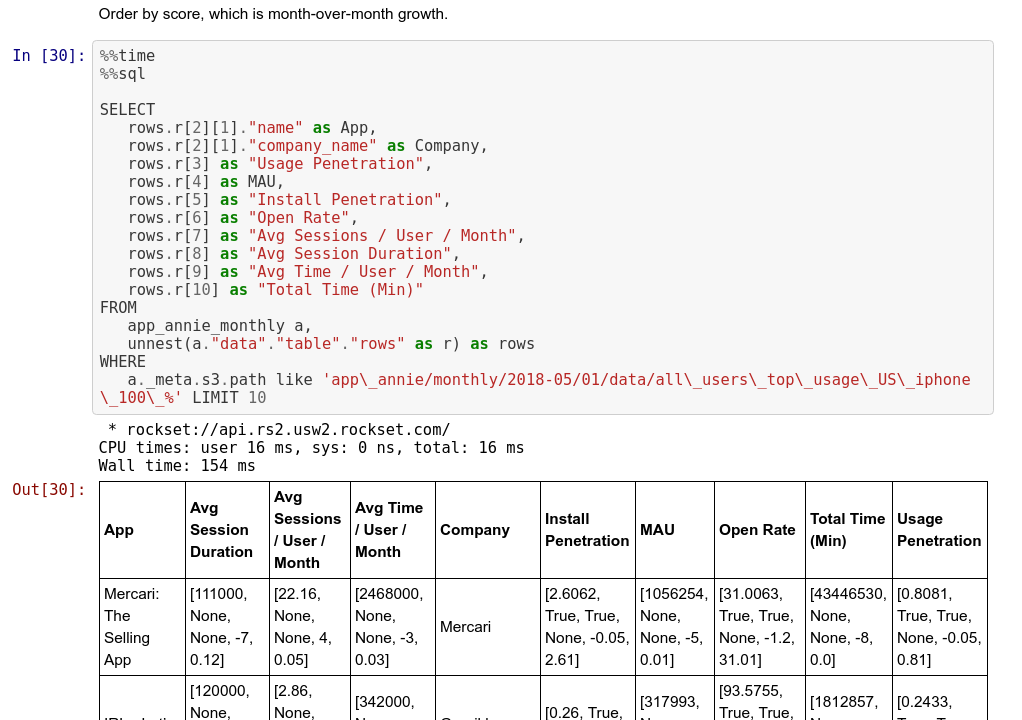

Operating SQL on nested JSON information

As soon as now we have understood the general construction of the nested JSON information set, we are able to begin unpacking the components we’re focused on utilizing the UNNEST command in SQL. In our case, we care concerning the app title, the share improve in MAU month over month, and the corporate that makes the app.

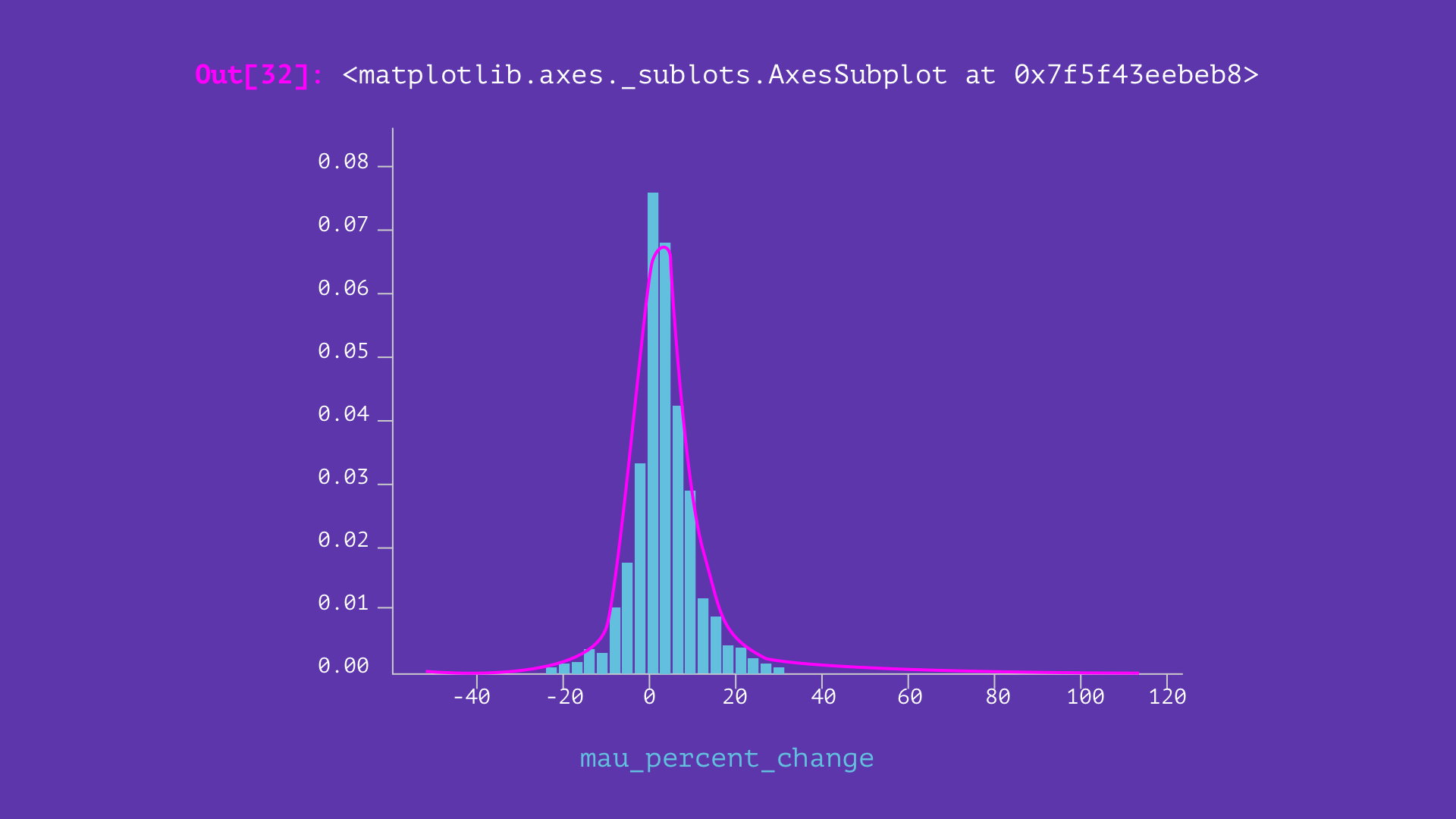

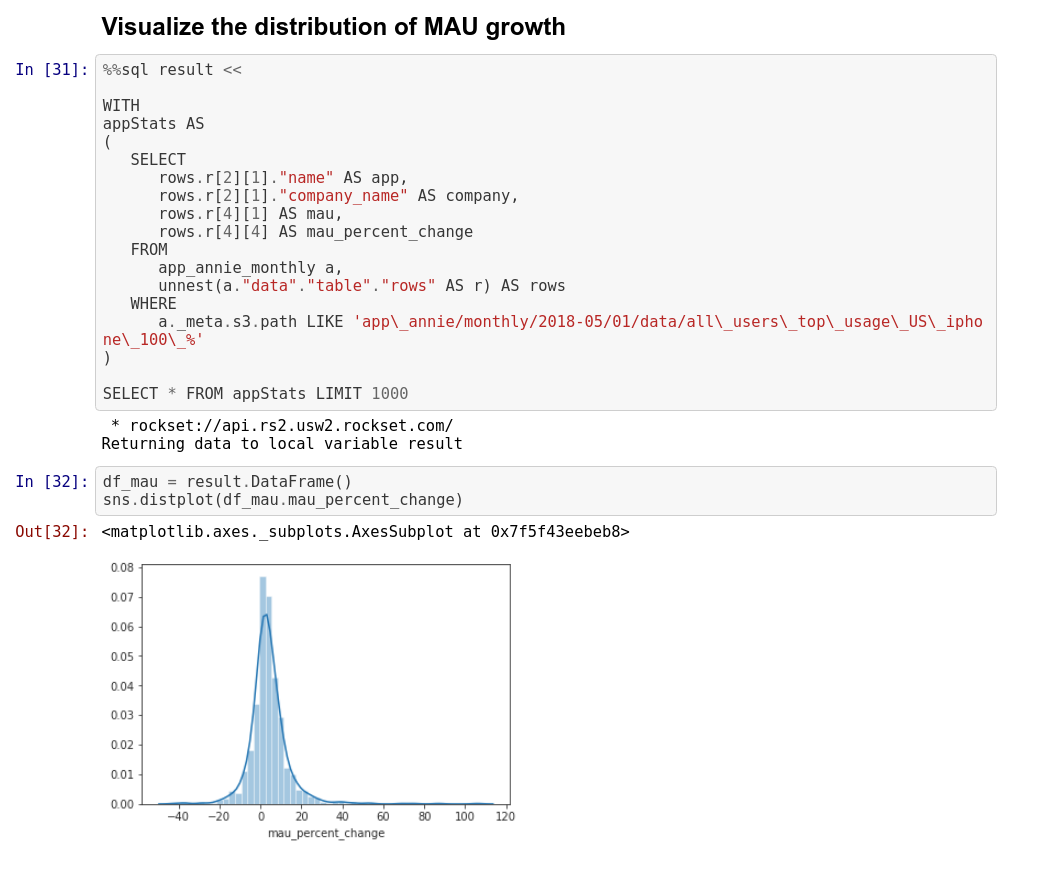

As soon as now we have gotten to this desk, we are able to do some primary statistical calculations by exporting the info to dataframes. Dataframes can be utilized to visualise the share development in MAU over the info set for a specific month.

Utilizing SQL to hitch the nested JSON information with CSV information

Now we are able to create the crunchbase_funding_rounds assortment in Rockset from CSV recordsdata saved in Amazon S3 in order that we are able to question them utilizing SQL. It is a pretty easy CSV file with many fields. We’re notably focused on some fields: company_name, country_code, investment_type, investor_names, and last_funding. These fields present us extra details about the businesses. We will be a part of these on the company_name discipline, and apply just a few extra filters to reach on the last listing of prospects for funding, ranked from most to minimal improve in MAU.

%%time

%%sql

WITH

-- # compute utility statistics, MAU and % change in MAU.

appStats AS

(

SELECT

rows.r[2][1]."title" AS app,

rows.r[2][1]."company_name" AS firm,

rows.r[4][1] AS mau,

rows.r[4][4] AS mau_percent_change

FROM

app_annie_monthly a,

unnest(a."information"."desk"."rows" AS r) AS rows

WHERE

a._meta.s3.path LIKE 'app_annie/month-to-month/2018-05/01/information/all_users_top_usage_US_iphone_100_%'

),

-- # Get listing of crunchbase orgs to hitch with.

crunchbaseOrgs AS

(

SELECT

founded_on AS founded_on,

uuid AS company_uuid,

short_description AS short_description,

company_name as company_name

FROM

"crunchbase_organizations"

),

-- # Get the JOINED relation from the above steps.

appStatsWithCrunchbaseOrgs as

(

SELECT

appStats.app as App,

appStats.mau as mau,

appStats.mau_percent_change as mau_percent_change,

crunchbaseOrgs.company_uuid as company_uuid,

crunchbaseOrgs.company_name as company_name,

crunchbaseOrgs.founded_on as founded_on,

crunchbaseOrgs.short_description as short_description

FROM

appStats

INNER JOIN

crunchbaseOrgs

ON appStats.firm = crunchbaseOrgs.company_name

),

-- # Compute companyStatus = (IPO|ACQUIRED|CLOSED|OPERATING)

-- # There could also be multiple standing related to an organization, so, we do the Group By and Min.

companyStatus as

(

SELECT

company_name,

min(

case

standing

when

'ipo'

then

1

when

'acquired'

then

2

when

'closed'

then

3

when

'working'

then

4

finish

) as standing

FROM

"crunchbase_organizations"

GROUP BY

company_name

),

-- # JOIN with companyStatus == (OPERATING), name it ventureFunded

ventureFunded as (SELECT

appStatsWithCrunchbaseOrgs.App,

appStatsWithCrunchbaseOrgs.company_name,

appStatsWithCrunchbaseOrgs.mau_percent_change,

appStatsWithCrunchbaseOrgs.mau,

appStatsWithCrunchbaseOrgs.company_uuid,

appStatsWithCrunchbaseOrgs.founded_on,

appStatsWithCrunchbaseOrgs.short_description

FROM

appStatsWithCrunchbaseOrgs

INNER JOIN

companyStatus

ON appStatsWithCrunchbaseOrgs.company_name = companyStatus.company_name

AND companyStatus.standing = 4),

-- # Discover the newest spherical that every firm raised, grouped by firm UUID

latestRound AS

(

SELECT

company_uuid as cuid,

max(announced_on) as announced_on,

max(raised_amount_usd) as raised_amount_usd

FROM

"crunchbase_funding_rounds"

GROUP BY

company_uuid

),

-- # Be a part of it again with crunchbase_funding_rounds to get different particulars about that firm

fundingRounds AS

(

SELECT

cfr.company_uuid as company_uuid,

cfr.announced_on as announced_on,

cfr.funding_round_uuid as funding_round_uuid,

cfr.company_name as company_name,

cfr.investment_type as investment_type,

cfr.raised_amount_usd as raised_amount_usd,

cfr.country_code as country_code,

cfr.state_code as state_code,

cfr.investor_names as investor_names

FROM

"crunchbase_funding_rounds" cfr

JOIN

latestRound

ON latestRound.company_uuid = cfr.company_uuid

AND latestRound.announced_on = cfr.announced_on

),

-- # Lastly, choose the dataset with all of the fields which might be attention-grabbing to us. ventureFundedAllRegions

ventureFundedAllRegions AS (

SELECT

ventureFunded.App as App,

ventureFunded.company_name as company_name,

ventureFunded.mau as mau,

ventureFunded.mau_percent_change as mau_percent_change,

ventureFunded.short_description as short_description,

fundingRounds.announced_on as last_funding,

fundingRounds.raised_amount_usd as raised_amount_usd,

fundingRounds.country_code as country_code,

fundingRounds.state_code as state_code,

fundingRounds.investor_names as investor_names,

fundingRounds.investment_type as investment_type

FROM

ventureFunded

JOIN

fundingRounds

ON fundingRounds.company_uuid = ventureFunded.company_uuid)

SELECT * FROM ventureFundedAllRegions

ORDER BY

mau_percent_change DESC LIMIT 10

This last massive question does a number of operations one after one other. So as, the operations that it performs and the intermediate SQL question names are:

appStats:UNNESToperation on the App Annie dataset that extracts the attention-grabbing fields right into a format resembling a flat desk.crunchbaseOrgs: Extracts related fields from the crunchbase assortment.appStatsWithCrunchbaseOrgs: Joins the App Annie and Crunchbase information on the corporate title.companyStatus: Units up filtering for corporations based mostly on their present standing – IPO/Acquired/Closed/Working. Every firm could have a number of information however the ordering ensures that the newest standing is captured.ventureFunded: Makes use of the above metric to filter out organizations that aren’t presently privately held and working.latestRound: Finds the newest funding spherical—in whole sum invested (USD) and the date when it was introduced.fundingRounds&ventureFundedAllRegions: Wrap all of it collectively and extract different particulars of relevance that we are able to use.

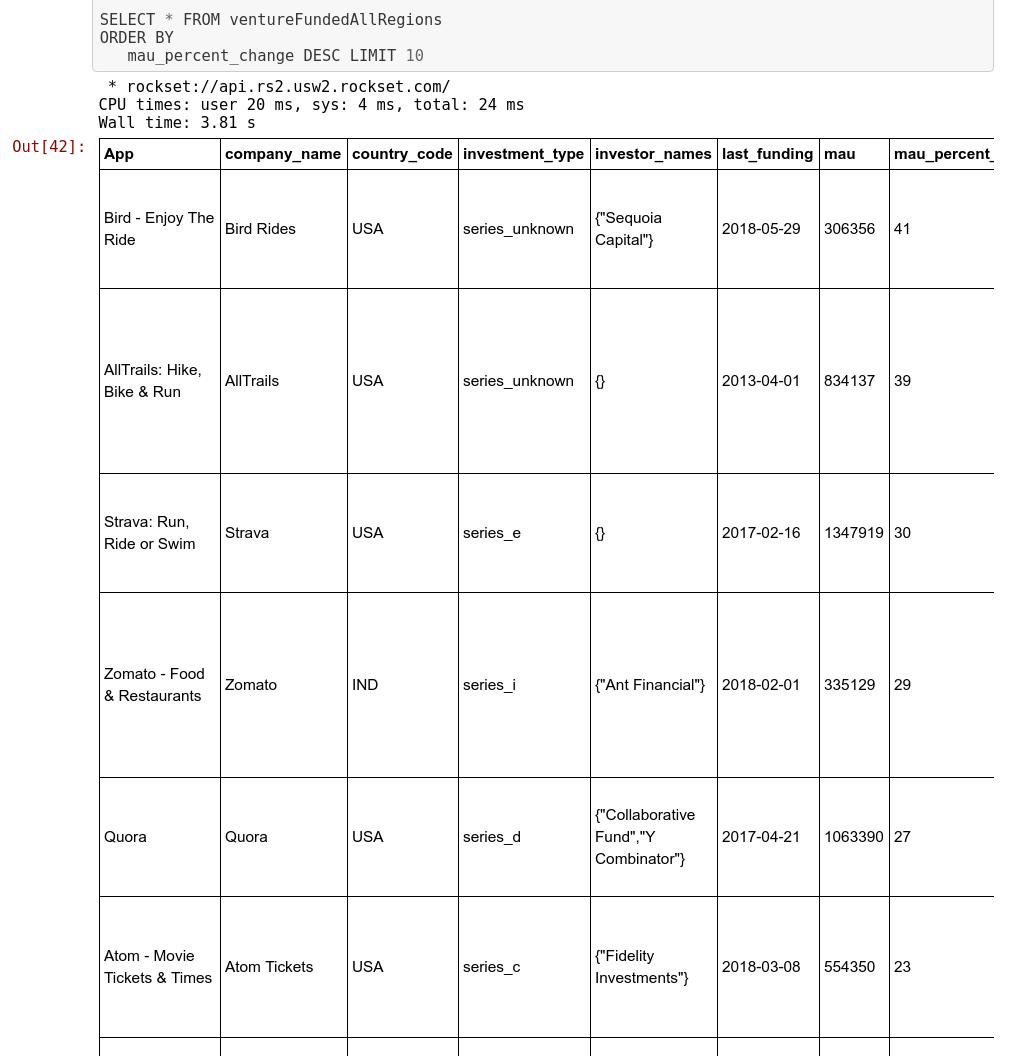

Information Science Insights on Potential Investments

We will run one last question on the named question now we have, ventureFundedAllRegions to generate the most effective potential investments for the funding administration agency.

As we see above, we get information that may assist with determination making from an funding perspective. We began with purposes which have posted important development in lively customers month over month. Then we carried out some filtering to impose some constraints to enhance the relevance of our listing. Then we additionally extracted different particulars concerning the corporations that created these purposes and got here up with a last listing of prospects above. On this whole course of, we didn’t make use of any ETL processes that remodel the info from one format to a different or wrangle it. The final question which was the longest took lower than 4 seconds to run, because of Rockset’s indexing of all fields and utilizing these indexes to hurry up the person queries.