September greetings from Kansas Metropolis, Cedar Rapids, and Charlottesville the place we’re attending a household marriage ceremony (image is of the Rotunda on the College of Virginia). A terrific celebration with household and mates and congratulations to the brand new Mr. and Mrs.

There’s loads of information to cowl this week, and, after a short market commentary, we are going to dive into two strategically essential occasions, First, as we began in final week’s interim Transient (right here), we are going to full our evaluation of John Stankey’s wide-ranging interview at Goldman Sachs’ Communacopia convention (hyperlink right here). Then we are going to dive ino as a lot of final week’s T-Cell Capital Markets Day as house will allow. For sure, we can have loads of materials for upcoming Briefs.

A giant thanks to Shiloh Vance at INDATEL for the terrific interview/ webinar since our final Transient was printed; right here’s a hyperlink. And because of every of you who’ve supported and proceed to help CellSite Options.

The fortnight that was

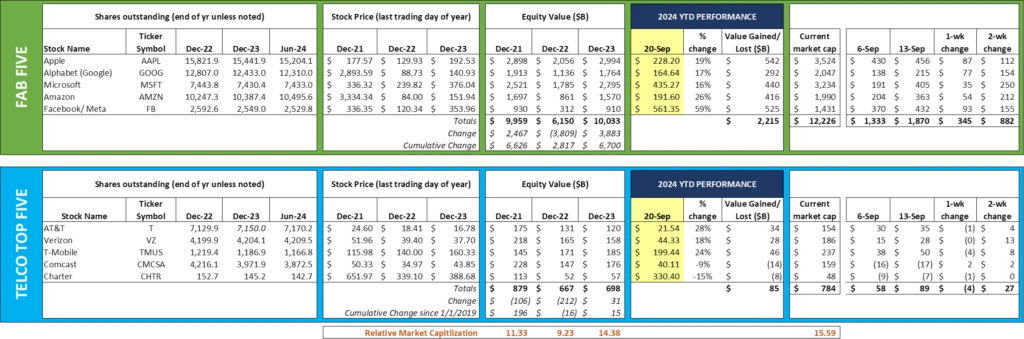

“In case you don’t like our climate, wait a minute” is the favored phrase first attributed to a January 1909 Discipline and Stream article. The identical may very well be stated for Fab 5 market capitalizations. Within the final Transient, we famous that the Fab 5 had misplaced near $600 billion over the 2 weeks ending September 6. Since then, they’ve gained $880+ billion with most of that coming earlier than the latest Fed rate of interest minimize. Whole market capitalizations are the place they had been firstly of July, and, because the numbers present, the worst performing inventory of the group is up 16% (which in Microsoft’s case represents $440 billion in positive aspects). Barring a big change to market sentiment or some particular occasion, it’s extremely doubtless that they are going to develop $2-3 trillion in market capitalization this 12 months.

In the meantime, the Telco Prime 5 is experiencing a renaissance, holding on to $85 billion in year-to-date 2024 positive aspects. As we now have mentioned in earlier market commentaries, this represents a $108 billion in wi-fi/ telco positive aspects offset by $22 billion in cable communications firm losses. With dividends, every of the big wi-fi firms are poised to return greater than 20% to shareholders in 2024. That trifecta has not occurred since 2017.

Apple had their iPhone 16 announcement, and we are going to publish our first take a look at backlogs later right this moment in a separate on-line Transient publish. There are various good summaries accessible on what has modified with the iPhone 16, however we discovered CNET’s to be probably the most complete (hyperlink right here). The photograph comparisons in that article additionally present how far Google’s Pixel 9 has are available digital camera high quality, notably with out of doors and low-light environments.

T-Cell has already indicated that their iPhone 16 gross sales volumes are forward of 2023 iPhone gross sales; their backlogs, nonetheless, are about the identical as final 12 months. Our take is that it is going to be a promotions-driven cycle (versus an AI-driven cycle): a very good however not nice displaying for Cupertino.

All isn’t roses for Apple, nonetheless, with the European Fee ordering Apple to pay Eire $14 billion in again taxes. Sarcastically, Eire was truly defending Apple within the case. Per this BBC article:

“The unique choice lined the interval from 1991 to 2014, and associated to the best way during which income generated by two Apple subsidiaries primarily based in Eire had been handled for tax functions. These tax preparations had been deemed to be unlawful as a result of different firms weren’t capable of acquire the identical benefits. That ruling got here at a time when the Fee was trying to clamp down on multinational giants it believed had been utilizing artistic monetary preparations to scale back their tax payments. It was overturned by the decrease court docket of the ECJ in 2020 following an attraction by Eire. Nevertheless, that verdict has now been put aside by the upper court docket, which stated it contained authorized errors.”

Eire is Apple’s HQ for Europe, the Center East, and Africa, and the advantages of internet hosting the world’s most dear electronics firm is important. What they are going to do with the windfall is anybody’s guess, and whether or not the $14 billion Apple paid to the US (as an alternative of Eire) is topic to a refund is anybody’s guess. As reference, the Emerald Isle collected 24 billion Euros (roughly $27 billion) in whole company taxes in 2022 (extra data right here).

If that isn’t sufficient of a headscratcher, we awoke Friday to the information that Constellation Vitality is being paid $1.6 billion by Microsoft to reactivate Unit 1 of the Three Mile Island nuclear facility in central Pennsylvania (Unit 1 was not impacted by the 1979 catastrophe and Unit 2 will proceed to be decommissioned on schedule). Because the information launch linked above signifies, the Redmond-based firm will likely be buying the entire power produced by the plant for the subsequent 20 years. The precise worth of the unique buy of power from a facility able to producing 837 megawatts of electrical energy for twenty years isn’t identified, however its influence to central Pennsylvania goes to be significant. We count on this to spawn extra modern power preparations from Microsoft and their friends.

Vitality sourcing goes to be an especially essential a part of crucial infrastructure improvement over the subsequent decade. Additionally, creating extra power environment friendly buildings (notably the place the grid is challenged) goes to be required. NB: it’s one of many greatest challenges being tackled by the crew at CellSite Options.

John Stankey goes natural at Communicopia

There have been many terrific audio system on the Goldman Sachs Communacopia + Know-how convention held on September 9-12. We listened to a number of, however thought that AT&T CEO John Stankey (hyperlink right here) had the best insights. He begins with the premise that extra computing energy (pushed by AI) goes to generate extra bandwidth necessities, and that to facilitate that demand, a fiber spine is required.

John then goes on to speak about why their fiber + wi-fi product (which he admits goes by means of a change) has higher long-term prospects than that provided by cable rivals (see the interim Transient hyperlink right here for the total quote). There’s loads to debate in his assertion that house doesn’t afford on this Transient version, however we consider that there’s a lot of room for each cable and AT&T (and T-Cell and Verizon) to accumulate prospects in areas the place AT&T is the incumbent wi-fi and wired infrastructure supplier. Having a terrific wi-fi backup helps, however so does having enticing costs and a price proposition that encourages trial of purposes and content material.

Probably the most intriguing assertion made by Stankey, nonetheless, are his feedback about capital and steadiness sheet investments:

“…we could run at a little bit of an accelerated larger than possibly conventional ranges of capital funding within the enterprise. It’s come down from peak and it’ll proceed to drop down. We could run a bit bit larger than the place we’ve historically been as a result of it’s principally natural. And we’re centered on natural play versus inorganic work outdoors that type of is available in massive chunks. The place you go whenever you name on the steadiness sheet all at one time and then you definately’re working by means of three or 5 years of transition. So I really feel actually good about the place we’re in that. I’ve by no means been on this enterprise the place I’ve seen as a lot natural alternative in entrance of us to run the enterprise higher. I like that as a result of doing issues organically, you don’t need to go and present up at a regulator and also you don’t have to string the needle on authorized points, and also you don’t have to indicate up in 25 states to get approval to do one thing and everybody needs to gather their toll whenever you present up and each particular curiosity needs to have their again scratched round one thing.

The administration crew is targeted on executing what we now have in entrance of us and what we’ve constantly had because the place for the final 4 years, and we’re getting higher and higher and higher at doing it, and that’s what we have to do. And I feel we’re arrange very effectively to do this. And I feel we’re going to have a very good equation of capital allocation shifting ahead.”

Apart from the plain dig at Verizon’s acquisition of Frontier (which mirrors a number of the considerations we now have concerning the transaction – see the final full Transient right here for extra), Stankey’s assertion units the stage for extra fiber spending (possibly with BEAD cash, however we don’t learn any type of dependencies into his assertion), and subsequently larger capital ranges than their friends.

This spending is pushed by elevated confidence of upper penetration of wi-fi + wireline in these beforehand marginal areas. It additionally accelerates extra infrastructure investments due to improved broadband. In contrast to earlier cycles, fiber could precede asphalt or concrete (and in a number of circumstances even strong wi-fi) infrastructure initiatives. That’s a giant change.

How AT&T explains the scale, velocity, and funding projections of their subsequent construct (after the 30 million properties milestone) goes to be essential. We’re not satisfied that they’ll obtain a sensible share in lots of markets with out buying present fiber suppliers in these markets or having significant regulatory reform (e.g., the resumption of the Inexpensive Connectivity Program) – prices have risen, and the mileage necessities for fiber haven’t decreased.

Backside line: AT&T continues to plow forward with their fiber-first technique. Their subsequent act will decide whether or not they can maintain and develop their market affect.

T-Cell Capital Markets Day—what it takes to be a champion

Final Wednesday, T-Cell hosted an investor day on their Bellevue campus. The theme of the day was “From Challenger to Champion” and the corporate outlined their plan to alter to an modern chief. Close by are the pillars they plan to make use of to ship their champion technique.

As said close by, T-Cell’s best inhibitor to successful the champion’s crown is their capacity to constantly execute new improvements. For instance: a digital future the place almost all upgrades and most inbound service name causes are dealt with with minimal/ no buyer interplay. The diploma of data know-how investments wanted to attain these targets is important. It requires rethinking every step within the course of. If a buyer wants to modify gadgets due to a customer-induced defect (e.g., a multi-story dropped smartphone), and subsequently can’t entry any of the telephone’s info, how can/ ought to the service restoration course of happen (assuming the shopper can’t entry any of the knowledge such because the IMEI on the system)? As T-Cell rethinks their digital technique, dozens of processes might both be mixed or eradicated. Sequencing and execution will likely be critically essential.

Whereas that’s their greatest concern, we appreciated their dialogue with Nvidia about extra capability. Right here’s the assertion made by Jensen Huang, their CEO:

“So when — however when someone doesn’t want it, that infrastructure is sitting there and it may very well be re-utilized. And so once we made a software program outlined, made it accelerated, made it capable of run AI processing. We now flip that complete community into extra capability whenever you want it for extra alternatives. And so that is going to be a terrific new progress alternative for the telecommunications business.”

This caught our ear given our wholesale background. Historically, wi-fi community suppliers solely wholesale particular outputs like minutes, textual content messages, and information packets. What Jensen was talking about, nonetheless, is definitely wholesaling the computing platform for both MVNOs or different industries. Given the “service grade” of most wi-fi networks, we thought that was an intriguing idea (so did Walt Piecyk from Lightshed Companions, who requested a selected query to T-Cell CEO Mike Sievert concerning the remark through the Q&A session. We discovered Mike’s reply to be much less enthusiastic than Jensen’s remark above). To be a champion, T-Cell might want to prioritize a big array of purposes and use circumstances that drive income and improve buyer satisfaction.

Lastly, T-Cell launched T-Precedence for presidency prospects (announcement right here). We like the thought and consider that it might (and will) be prolonged to different purposes, even when it signifies that they should combat the notion that business precedence equates to paid prioritization. We’ll go into this in higher element in a post-earnings transient, however T-Cell must have equal footing throughout the FCC and state PUCs with each Verizon and AT&T if they’re to say the championship mantel.

Backside line: T-Cell’s string of bulletins positioned the corporate in a “future-focused” class. To grow to be an business influencer, nonetheless, they are going to want to have the ability to execute the place there isn’t a precedent playbook, aggressively allow others to make use of extra capability when accessible, and set up a popularity with authorities our bodies that they’re know-how leaders who can set up precedence lanes whereas growing total scale. It is a tall order for any know-how firm, however particularly one who serves all segments.

That’s it for this week. Search for the primary Apple iPhone 16 availability charts tonight, and within the subsequent Transient, we are going to pose ten questions for third quarter earnings. Till then, when you’ve got mates who wish to be on the e-mail distribution, please have them ship an electronic mail to [email protected] and we are going to embrace them on the checklist (or they’ll join instantly by means of the web site).

Lastly – go Sporting KC, Kansas Metropolis Chiefs and Kansas Metropolis Royals!