Ranging from the bottom, investing apps are digital websites that refine the method of investing & managing monetary portfolios. Residents allocate their piggy banks into ventures wanting to generate future restoration and amplification of a potbelly.

Nearer, for a person or an enterprise, money restorations could embrace shares, bonds, ETFs, mutual funds, & cybercurrencies, with actual property setting on prime.

These collected property suggest quite a few advantages for residents, first & foremost vesting them to diversify their cash reserves. They grant multifariousness to possessions, diminishing the chance of cash misplacement.

Arguments to personal on-line funding app

Due to this fact, investing apps alter the way in which individuals interact in monetary actions, encouraging traders to handle their cash briefcases from anyplace. With the growing demand for usable spots that proffer shielded transactions and sagacious analytics, devising an investing app seems as an thrilling enterprise shot.

Cash accumulation serves residents to unfold property throughout classifications or websites, pushing prosperity amplification, & aiding individuals to realize monetary requirements. Withal, investments steadiness dollars-&-cents self-discipline, forcing clever investing habits. As an example, it backs up retirement & schooling financial savings.

As for companies, placing cash properly conveys an organization’s progress for the approaching by equating dangers, correcting liquidity supervision, & abiding by short-term obligations & properties.

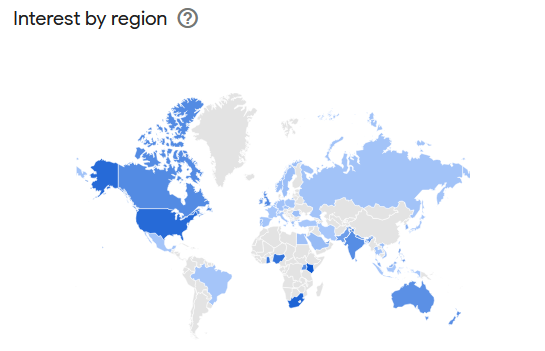

Investing cash developments by area, from Google Traits, 2024

Based on Google Traits, the U.S., Canada, alongside Australia are the states with the loftiest demand for investing cash. So, examine events of the way to make funding apps and path your investments in a conscious and irresistible means.

So, it implies incorporating in your app options and funding choices that thoughts up about these behemoth states—the utmost investing influencers. To understand this perception at full capability, grasp this imaginative and prescient to draw highly effective firms’ insights to your on-line funding app.

Because you perceive the worth of a fiscal pack for purchasers, how about creating your funding app, could it additionally produce perks for single individuals & enterprises?

On this information, we’ll take you thru these important strikes and cogitations to craft a thriving funding app, additionally consolidating stability.

What Are Funding Apps?

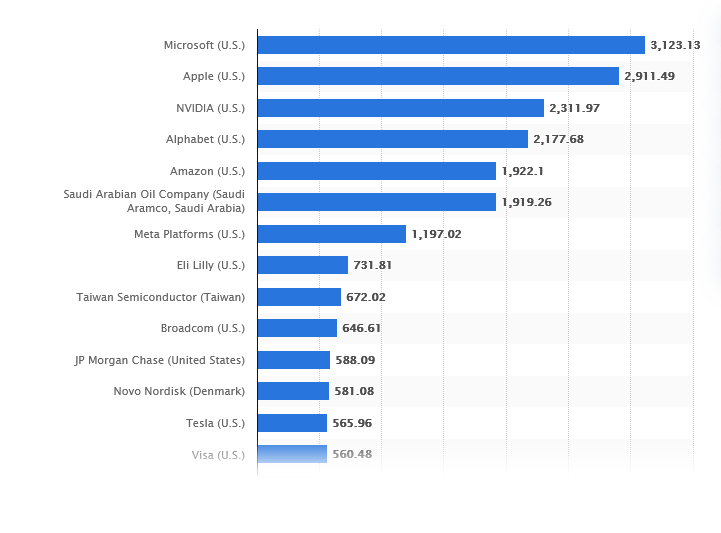

Making an allowance for these 100 greatest enterprises on this planet by market capitalization in 2024, it will be advantageous so that you can preserve monitor of their triumph data and pull out some insights.

Now, for the reason that sixteenth century, the New York Inventory Change (NYSE) is the topmost inventory market globally, with a market cap of practically $30 trillion. To assessment this globally, it’s greater than the whole financial output of most international locations.

There are about 60 main inventory exchanges worldwide, as per Statista. The oldest is the Amsterdam Inventory Change (now Euronext partly), based in 1602. This was the onset of latest inventory buying and selling, shaping monetary markets as we all know them as we speak. In the meantime, essentially the most potent world actor in inventory markets is the U.S.

It guides the world attributable to its robust monetary historical past and guidelines, internet hosting 1000’s of native and worldwide firms, together with the most important world manufacturers. In the meantime, Japan Change Group and Canada’s TMX Group have essentially the most firms listed, every with near 4,000.

Prepared to understand how they made their revenue on on-line funding apps, make a sensible journey into the depths of our complete article on inventory funding purposes, with the very best digital funding choices & websites.

Past that, scrutinize the looming inventory funding markets in China, India, & Brazil. These are named “rising” attributable to their swiftly increasing deposits. Although perilous attributable to political shifts, they beckon traders & are creating into extra financially mattered websites.

So, don’t overlook them whereas producing your on-line funding app.

100 wealthiest worldwide firms by market capitalization, Jul 2024, in billion $U.S., Statista

Kinds of Funding Apps

Whereas constructing your inventory funding app, the foremost level is to pick between the kinds of investing apps. This shift will foster the checking course of for you on which area of interest to focus on.

Summing up, the core objective of funding banking apps is to empower residents with the potential for absolutely dealing with their outlay. However, the analogous course of takes place in each investing cell app improvement, however the bundle of options differs, so let’s dive into the main points.

Robo-Advisors

Simply commencing your journey with funding cell apps, or having excessive deficiency of time, you could put your eye on these on-line funding platforms. Chasing down for low-cost and simplified apps, have a look at Wealthfront or Betterment.

They robotize funding administration by way of algorithms and low charges to craft & rebalance financial briefcases, additionally due to letting you make passive outlay. These yielding app fashions are predicated by person predilections, monetary aspirations, & danger tolerance.

Thus, robo-advisors are modifying the way in which individuals attain out to speculate with low charges below the belt.

Human Advisors

Not like automated digital spots for financing, the beautiful work is ready right here by approved professionals in financing. Keen to make use of their cash correctly, individuals eagerly profit from knowledgeable funding recommendation, and thus, are wanting to be charged additional for the perk of human experience.

Now, human advisor apps accommodate purchasers with giant cash circumstances, insisting on a extra hands-on approach.

One excellent illustration of such an app is Private Capital, a virtuoso app for high-net-worth people to supply customers with refined monetary objectives. It carries out a mixture of know-how and human experience to information customers via knotty budgetary choices, enriching them with straight connections—from retirement planning to wealth surveillance.

Banking Apps with Funding Potential

As soon as you’re lacking a monetary software to include funding, you’re in the best place. Banking apps with funding options just like the distinguished Revolut and Chime uphold customers in dealing with their funds and investments in a single spot. So, banking apps mix routine banking with buying and selling shares or cryptocurrencies, integrating funding instruments that merge on a regular basis monetary oversight with depositing events.

Observe your financial savings, notice tradings, & conduct index funds’ investments, multi functional place. This comfort fosters holistic monetary management, however customers could miss out on the superior instruments or in-depth analytics offered by devoted funding purposes.

The app is a fabulous choose for patrons in search of simplicity and unified monetary administration.

Hybrid Apps

Mixing robo-advisors and human-backed apps, hybrid options excel as a combo magnifying the perks of each options. As a promising monetary course, it encompasses automated improvements with human mastery, this fashion turning investing into an expensive journey.

Accessible, environment friendly, and personalised for customers who need the comfort of digital instruments but in addition worth the steerage of monetary professionals. Right here’s a better have a look at how hybrid funding apps work, their key options, and why they rework the funding panorama.

A number of potent circumstances are Betterment Premium, Private Capital, & Vanguard Private Advisor.

Micro-Investing Apps

This sort of app seems as greater than only a starter-friendly utensil. Bragging polished exteriors with the likelihood for tradesmen to remain versatile, micro-investing devices grant the choice for judiciously saving money.

A perk of this funding app is a cell & low-charge entry into the investing discipline, in order that merchants could check brand-new investing recipes or automate part of their cash briefcase into tech-shrewd experience. Equally, these apps sanction patrons to put money into parts.

Like this, merchants could buy quotas of high-value shares (assume Tesla or Amazon), thus, branching out their budget-free money. Apart from, micro-investing options instruments make duties of cash briefcase surveillance automatable, liberating your time. Furthermore, they supply certified information evaluation proper within the app, with funding methods & routes to filtered briefcases, all by tracing your productiveness on-line. Preserve fruitful studying paths alongside the way in which!

The fruitful circumstances of micro-investing apps are Robinhood & Acorns.

For an augmented perspective, put in your investing pocket extra kinds of cash investing apps: funding portfolio administration, instructional funding apps, & inventory buying and selling apps.

Essential Options of Funding Apps

- Zero / low buying and selling costs on frequent offers.

- Simplified monitor to plentiful property (ETFs, cybercurrencies, and so forth)

- Refined analytics with efficiency diagrams, inspecting dangers, & mart flows.

- Embedding exterior monetary instruments/apps for flexibility.

For an augmented perspective, put in your investing pocket extra kinds of cash investing apps: briefcase administration, instructional funding apps, & inventory buying and selling apps.

Key Options of an Funding App

To face out in a aggressive market, your funding app should embrace the next core options:

Nucleus Traits of an Funding App

- Straightforward-to-comprehend interface. An effortlessly readable format provides readability in numbers, additionally entitling the swift searching via an internet funding app—even for funding newbies.

- Registration and welcoming show. Make the most of multi-step verification with secure biometric entry to pledge sturdy safety. Assist creating funding accounts handily with protected signing-up add-ons and an intuitional onboarding—with entering into key functionings.

- Shopper profile. Accredit patrons to control over their predilections, observe cash briefcases, & study fiscal exercise per a handy panel.

- Transaction oversight. Elucidate deposits and money pullbacks, with funding gross sales, but, sustaining a transparent file of all monetary actions.

- Integration with the fiscal platform. Tie your inventory funding app with banks to harmonize person accounts and supply exact financial inputs.

- Protected & snug buying and selling. Grant purchasers the choice to buy & vend property straight inside the app with decreased retardations. Qualify them to course of this measure instantly inside the app to hoist your app over the rivalries.

Extra Options of an Funding App

- Embedding analytical insights & market information. Carry efficiency imaginative and prescient, market currents, & surge forecasts to direct customers to make conversant judgments. Furnish your funding banking app with related market streamlines and commerce prices, with monetary information as the ultimate flourish. This may solidify your guests’ perspective on the developments.

- Experiences and streams. Dwell changes on market affairs, feedback, & communications to remain abreast of the adjustments with a compelling board of investing devices.

- A mix of features KYC & AML. Figuring out your buyer & anti-money laundering embeddings intensify customers’ security. They authorize customers to speculate and abide by governing notes to flee dishonest measures.

- Searchings and filters entitle customers to comfortably discover shares, funds, or different funding alternatives on specific qualities like danger profiles.

- Instructional move. So, embed handbooks, thematic essays, & tutorial movies on investing matters.

- Digital counselor. Embed AI-guided consultants to abet customers with portfolio supervision and funding situations affiliated with their objectives.

- Push reminders. Convey well-timed changes on costs, market flows, or portfolio mileposts for customers being tuned.

- Asset calculator. Current equipment for appraisal of potential earnings in step with movable parameters like funding quantity, time, & danger favorable.

- Customer support. Provide your inventory funding app with built-in chat or shopper assist potentialities. This fashion, your guests will swiftly resolve arising challenges or get applicable assist.

- Portfolio monitoring. Authorize customers to hint their funding data & oversee the efficiency & property’ allotment.

- Guarded fee gateway. Certify protected transactions for deposits and pullouts by way of codified on-line paying routes.

Steps to Construct an Funding App

Coming nearer, the worldwide financial system is discovering its footing after years of successive adversarial shocks. Regardless of ongoing geopolitical tensions, all-over-the-world buying and selling exercise gained energy in early 2024. With this tendency below the belt, financial hoisting is projected worldwide, shifting at a barely faster tempo than earlier. That is largely tied to the regular momentum of the U.S. financial system, and right here‘s one other privilege of sticking to the funding app improvement

Therefore, world buying and selling is progressively hoisting, supported by tourism that has practically returned to pre-pandemic ranges. Despite the fact that the general commerce stance lingers tepid in comparison with previous years, the juice of creating a prolific funding app is unquestionably well worth the squeeze.

Constructing an funding app requires a mixture of technical experience, market information, and user-centric design. By fastidiously planning and executing every part, you’ll devise your money-investing app that qualifies clients to avoid wasting money prudently and safe a spot within the dynamic fintech variety.

Effectively, how do you go about creating a cell funding app? There’s the plunge into the subject.

Define Your Area of interest and Goal Guests

Earlier than diving into the event of funding purposes, analysis the market. On this survey and discovery chapter, determine your target market, examine the competitors, & decide which options your app ought to possess. Portfolio course, inventory monitoring, information feeds, & secure fee integrations are important. It’s additionally important to replicate on the enterprise mannequin and monetization methodology (e.g., premium subscriptions, commissions on trades).

Catch Up on the Area Phase You Wish to Serve

Every plentiful app commences with a profound understanding of the market, target market, & key challengers. This part contains holding market analysis, person interviews, and investigation into contenders to disclose and refill gaps in working ware. Use this perception to outline distinctive promoting factors in your app.

For example, take a shopper who needs to construct an funding app concentrating on younger professionals new to investing. By way of an enlarged advertising survey, we disclosed a scarcity of instructional content material for newbies. That is an knowledgeable choice to include instructional modules inside the app, serving to customers find out about funding ideas whereas utilizing the platform.

Decide a Monetization Technique

Resolve how your funding app will generate revenue whereas retaining your viewers and app worth in thoughts. Provides-on incorporate in-app advertisements, premium subscriptions, transaction charges, or a mixture of these. The secret’s to search out the best steadiness — keep away from overwhelming customers with too many advertisements or charges which may drive them away.

Focus on the Correct App Improvement Firm

Therefore, begin by testing software program improvement firms and searching via their portfolios. At this level, seek for their consultants’ applicable expertise in producing funding apps in your case.

Stroll via their case research to search out what you require and be choosy. Handle previous references and data on initiatives carried out, in order to painting the precise associate in your app enterprise.

Constructing an funding app insists on a profound comprehension of each the monetary panorama and the technical features of cell app craft. Right here’s how one can proceed.

An intuitive and user-friendly interface is important for any funding app. A clear design ensures customers can simply navigate their monetary information, whether or not by buying shares, viewing developments, or studying funding information.

In considered one of our initiatives, we prioritized making a minimalist design for the app’s house display, permitting customers to rapidly see their briefcase efficiency. We additionally built-in easy, interactive graphs for visualizing their investments. Suggestions from preliminary person testing helped us refine the design to make it much more accessible.

Go for the Proper Tech Stack and Improvement Method

Deciding on the relevant know-how in your objectives is crucial. It’s the center of your app guaranteeing your cash funding app can have the potential for scaling, retaining efficiency, & safeguarding buyer information.

So, choose the correct stack for front-end, back-end, & database improvement. Customary decisions sometimes stand in selecting React Native for cell apps and AWS or Google Cloud for back-end providers.

Thereupon, SCAND makes use of industry-leading applied sciences to construct dependable and high-performance apps.

As an efficacious instance of devising a inventory buying and selling app at SCAND, whereas crafting software program for buying and selling, you could go for React Native for the front-end. This shift will enable your organization to construct a cross-platform (iOS and Android) effectively. On the back-end, we built-in Node.js and MongoDB for seamless information administration and high-speed transactions, which is crucial for buying and selling apps.

Apart from, there are two principal approaches to app improvement — native and hybrid. Native apps are constructed for particular working methods (iOS or Android), providing a seamless expertise however may be costlier. The hybrid methodology empowers each iOS apps and Android websites, saving improvement time and app improvement prices however may not be as optimized as native options.

Combine Safety Measures

Safety is an obligation in monetary apps. At SCAND, we combine best-in-class safety measures and requirements, corresponding to two-factor authentication, encryption protocols, & safe API integrations to safeguard person data & transactions from hacker raids.

Taking for example our firm, when designing a money-investing app for buying and selling, we preserve centered on shielding customers’ privateness. So, our app builders embed military-grade encryption and multi-signature authentication to flee from hacking entry. We additionally built-in fraud detection algorithms to flag suspicious actions, guaranteeing the platform’s integrity.

Past that, name to perspective conformity with information security rules. Incorporate information encryption, SSL, and safe APIs. Adhere to monetary provisions like GDPR, PCI DSS, or legal guidelines on the bottom.

Again-Finish Improvement and Embedding APIs

Therefore, incorporating central options and necessary performance is a . Place the options that align together with your area of interest & add worth for purchasers within the first row. Keep in mind to wireframes or prototypes to map the person journey.

The back-end structure ought to deal with complicated monetary information effectively. So, collaborate with builders to include APIs for issues like real-time merchandising information, fee processing, or robo-advisory providers, & don’t neglect about banking methods. Make sure that your back-end can develop with the person numbers enhance.

This stage is the place the precise improvement occurs. SCAND’s skilled app improvement staff works to carry the app to life, integrating third-party APIs for market information, monetary transactions, and fee gateways.

As an example, for a inventory buying and selling app, you’re really useful to cope with APIs from monetary information suppliers like Bloomberg and Reuters to make sure real-time market information uninterrupted integration, along with on-line fee (e.g., Stripe) for protected procedures.

Testing and High quality Assurance

Extreme testing is ponderous in monetary apps as these should be dependable and error-free, with Agile methodologies at hand. Accordingly, your testing interval ought to cowl efficiency, safety, & person expertise throughout varied units and platforms.

Rigorously checking your funding cell app is essential to figuring out & resolving any errors or usability features. Mainly, SCAND conducts intensive testing for efficiency, safety, & person expertise.

Launch, Publish-Launch Backup, & Promotion

As soon as your app is overly developed and examined, roll it out on the respective app shops like Android. Use digital monetization methods (social media, content material advertising, and so forth.) to entice customers. Nonetheless, the work shouldn’t cease there, present buyer assist, launch updates, & monitor app efficiency to ensure fixed person delight.

At SCAND, we help purchasers with the deployment and launch of all relevant app shops. Publish-launch, our improvement staff holds on to supply ongoing backup, guaranteeing the app stays useful, shielded, & up to date.

Collect Suggestions and Iterate

Lastly, surf the person conduct and collect suggestions to bolster options, regulate bugs, supplying updates recurrently to know the whole pack of success.

Leveraging S&P 500 Knowledge in Funding Apps

Total, the S&P 500 index trails the achievement of the five hundred guiding U.S. companies, so it’s extremely uncovered to market oscillations. Musing the way to create an funding app, take these firms’ perceptions in your product’s profit.

Furthermore, method these information beneath as a precious yardstick for inspecting market drifts for truly-based funding resolutions. Right here’s the way you could apply this data in your inventory funding app:

- Perspective on market conduct. Therefore, your app can show stay information with fiscal vogue from contained in the S&P 500 companies to know the market values.

- Portfolio yardstick. With this side in perspective, potential traders will evaluate their portfolio’s efficiency to this sphere, thus, sticking to the true tendencies of their investments’ boons.

- Funding recommendation. Your app’s customers could make the most of the S&P 500 zone and information to underscore high-performing or undervalued companies, diversifying their funding briefcases.

- Instructional objects & market indices. Incorporate this precious information into manuals to coach customers on clever investing.

By integrating S&P 500 information, funding apps grow to be extra sturdy instruments, equipping customers with the data they should navigate markets successfully and make smarter monetary choices.

Examples of Profitable Funding Apps

Therefore, observe a few of the greatest funding platforms that you could pay tribute to whereas crafting your product.

Wealthfront

This app, Wealthfront, embeds computerized investing with full-fledged monetary preparations, proving customers to be potent in directing their wealth in a single app. It employs refined algorithms to ship environment friendly, low-cost funding options.

- Robo-advisory providers with diversified portfolios.

- Monetary planning instruments for retirement, house shopping for, and schooling.

- Money administration accounts with increased rates of interest than conventional banks.

- Tax-efficient methods, together with direct indexing.

- Wealthfront stands out for its all-in-one method, combining funding surveillance with monetary scheduling. Its tax-efficient methods and money administration options entice customers in search of long-term progress and monetary stability.

- Routine calls out to new traders, turning inventory buying and selling into a straightforward pie course of.

E*TRADE App

That is an exhaustive investing app that distributes to customers every part—from on-line offers to retirement planning. Due to the full-cycle bundle of funding devices, real-time market data, with instructional instruments for the angle on prime, E*TRADE turns investing into an inexpensive recreation for hundreds of thousands.

With its native-looking exterior and sweeping suite of options, E*TRADE brags the next features, each advantageous to newbies and enlightened merchants:

- Like different instruments, this app affords a variety of funding commodities—ETFs, models, trusts, choices, futures, & bonds enriching sellers with miscellaneous cash briefcases applicable for his or her monetary aspirations.

- Retirement and holding financial savings, clear and intuitive show, multifarious account sorts like IRAs & deposit accounts—with all below the belt the E*TRADE app is a prevalent selection for planning for retirement or saving for his or her kids’s future.

- With this, the app provides possession of potent devices for dealing to swiftly observe their portfolio & hint efficiency, by conducting trades fluently.

- Extra so as to add, it’s enriched with platforms of E*TRADE Core—for sporadic traders, with integral instruments for buying and selling, surveying, & profile course, and Energy E*TRADE—for industrious merchants. It encompasses devices for superior charting, danger inspecting, & adjustable buying and selling methods’ picks.

Coinbase

One of many foremen within the cryptocurrency enterprise, Coinbase amplifies customers’ expertise in shopping for, promoting, and gathering digital coinage. Its heightened tiers of information safety and ease of use have made it an superior web site for cryptocurrency lovers prepared to speculate properly with no strings connected.

Its performance boasts killer options like:

- Assist for over 200 cryptocurrencies, with Bitcoin & Ethereum on prime.

- Progressive buying and selling devices for skilled merchants by way of Coinbase Professional and guarded digital purses for saving digital property.

- Instructional property to achieve crypto via puzzles and manuals with a simplified interface entice freshmen, whereas its superior traits are directed at practiced crypto merchants.

- Serving to with buyer calls, adjustable reminders, and wonderful survey devices full the Coinbase victory lap.

Binance

This terrific cryptocurrency change digital terrain is without doubt one of the hugest apps worldwide, boasting its huge vary of digital property and progressive buying and selling traits. The shining perks are a large & sturdy buying and selling devices array, & highly effective safety actions. Excellent performance for newcomers and practitioners alike:

- Upholds a number of world cryptocurrencies, together with Bitcoin & Ethereum.

- Renders progressive buying and selling instruments like futures & margin buying and selling.

- Protected cash pouch integration to retailer & direct digital financial savings.

- Instructional sources to assist customers perceive blockchain know-how and crypto investments.

Challenges in Creating an Funding App

Despite the fact that creating an funding app is a worthwhile enterprise, it comes with important challenges. Fintech builders ought to stroll via intricate monetary rules, perform sturdy cybersecurity measures, & devise intuitive interfaces that cater to each novice and skilled traders.

Moreover, embedding real-live information, maintaining scalability, & strengthening belief in an formidable area provides shades of complexity to the event course of.

Safety Dangers

Investing apps are prime targets for cybercriminals. So, operating sturdy safety measures corresponding to encryption, biometric authentication, and safe information storage are intrinsic however extraordinarily important.

Embedding Market Knowledge

Entrance to real-live market data is essential for funding apps. Integrating dependable third-party APIs for inventory market information, monetary information, and buying and selling updates requires cautious planning to make sure accuracy and reliability.

Regulatory Conformity

Primarily based on the area, funding apps should stick with extreme safety pointers. For instance, apps providing funding providers within the U.S. should adhere to SEC (Securities and Change Fee) insurance policies. Acquiring the mandatory licenses and guaranteeing information privateness may be difficult.

Person Reliability

Constructing person belief is important for monetary apps. Implementing high-level safety, clear payment constructions, and providing wonderful buyer assist may help construct credibility in a aggressive market.

How SCAND Can Assist You Create an Funding App

At SCAND, we specialise in constructing high-performance, safe, and user-friendly funding apps that meet the very best {industry} requirements. Whether or not you want a fundamental platform for portfolio administration or a complicated app with cryptocurrency buying and selling, SCAND’s consultants in coding and design can flip your imaginative and prescient into actuality.

Our consultants steadiness the mergeк of user-easiness, safety, and high-end applied sciences that run far. We deal with every part from preliminary analysis and planning to post-launch assist, guaranteeing that your app not solely works flawlessly however stands out within the aggressive market.

Prices of Creating an Funding App

The expenditures for creating an funding app depend on multifarious features. Thoughts incorporating and estimating separate budgets for the design, improvement, & testing of the web funding app, together with your on-line funding apps’ geolocation on prime. Observe a preliminary breakdown beneath:

Design

Crafting an intuitive and interesting person interface could disburse between $10,000 & $30,000. This part focuses on wireframes, prototypes, and visible components that ameliorate useability.

Improvement

Constructing the integral and progressive functionalities sometimes requires $50,000-$150,000. This contains coding, back-end structure, API integrations, & cell platforms’ cohesiveness.

Testing and High quality Assurance

Guaranteeing dependability & app productiveness via rigorous testing can roam from $10,000-$20,000. This chapter identifies and resolves bugs, safety weaknesses, and efficiency bottlenecks.

Withal, a mid-range app with sturdy options and cross-platform compatibility typically falls within the $100,000-$200,000 scope.

One other perspective is to treat an app’s crafting with the variety of traits in view.

Therefore, the price of crafting an funding app varies primarily based on a number of components, together with the intricacy of options, platform (iOS, Android, or each), and the event staff’s location.

- A fundamental funding app with fundamental performance, corresponding to portfolio administration and inventory monitoring, shifts between $30,000 to $60,000.

- A medium complexness app with embeddings like real-live data, protected on-line fee service gateways, and person authentication will enhance the fee to $60,000-$120,000.

- An developed app enriched with high-experience options like cryptocurrency dealing, embedded monetary providers, AI-driven insights, & professional-grade safety might attain from $120,000 to $300,000 or extra.

It’s important to consider ongoing upkeep prices, corresponding to updates, safety patches, and server administration, which may cost a further 15-20% yearly of the overall improvement value.

FAQs

How a lot does it value to develop an funding app?

As talked about, the worth can roam from $30,000 to over $300,000, grounded on the app’s elaborateness and traits.

How lengthy does it take to construct an funding app?

It usually takes 1,5-2 trimesters for a fundamental funding app, however extra complicated platforms might take as much as a yr or extra.

Can I embrace cryptocurrency buying and selling in my funding app?

Sure, cryptocurrency buying and selling may be built-in into your funding app, but it surely requires adherence to safety requirements and regulatory compliance, notably in several areas.